Despite the cost-of-living crisis we think ‘UK plc’ is in better shape than it is given credit for

Macro headwinds exist, but we think the negative sentiment is extreme and are aware markets can change quickly

We are patient investors and will concentrate on long-term company fundamentals and not just the next six months

For those of you old enough to remember 1978-79, we lived through what was known as the Winter of Discontent1. One of the most famous depictions of this was Leicester Square overflowing with rubbish bags after the binmen – or waste operatives, as we might say nowadays – went on strike. Overlooking this scene were billboards for the films showing at the square’s famous cinemas at the time. These were, somewhat ominously and appropriately, Jaws 2 and Damien: Omen II.

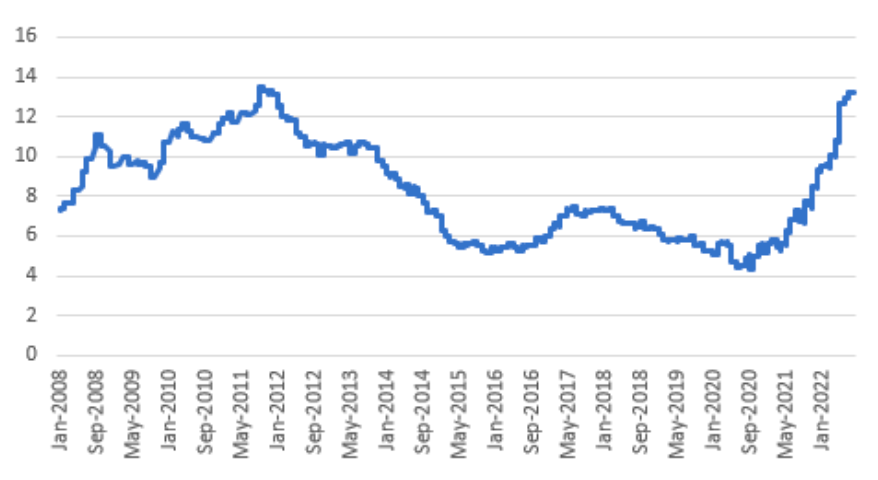

Talking of horror show sequels, Andrew Bailey, Governor of the Bank of England (BoE), is now painting a picture of a similar winter ahead of us this year with the cost-of-living crisis gripping the UK, inflation hitting double-digits for the first time since the early 1980s2, and widespread industrial action3. In 1978 Ian Dury & The Blockheads appropriately sang “What a Waste”, but given all of the above, and with the UK Misery index – a combination of inflation and unemployment – climbing for the best part of two years (Figure 1), it’s a Blockheads song from 1979 that we’re interested in: “Reasons to Be Cheerful, Part 3”.

Despite the song’s name, the Blockheads never released parts one or two. But in terms of outlooks we have always been on the lookout for a positive spin. In December 2019, with the UK’s withdrawal from the European Union set to be finalised, we wrote a viewpoint called “The

land that time forgot”4, in which we argued that the greater clarity around Brexit would spur a stock market rally and encourage a longer-lasting reappraisal of UK-listed companies. Then, in May 2021 as the world began to reopen following the Covid pandemic, we published “The crowds are returning”5, in which we noted increasing numbers of investors looking to the UK. And now, despite everything we’ve touched on above, once again we think there are still reasons to be cheerful … part 3!

Figure 1: UK Misery Index

Source: Bloomberg, 2022

Of course, countries around the world are experiencing issues – many of which are global and shared – and the UK is facing the very real prospect of hardship for many consumers and families. But if you lift the bonnet on “UK plc” the data looks pretty robust:

- Households have a spending buffer worth 11% of GDP based on excess savings and consumer credit headroom

- Non-financial corporations have enough excess cash that they could comfortably withstand a 2008-09-style cash burn

- Banks’ capital ratios at the start of 2022 were nearly four times higher than pre-global financial crisis and even in case of a 2008-style shock would still have twice as much Tier 1 capital as they did in 2007

- UK public sector debt maturity is the longest among developed nations – and double the OECD average of eight years

- Unlike during the global financial crisis, financial fragilities should not exacerbate any recession scenario – and the economic recovery needn’t therefore be held back by necessary balance sheet repair

- The UK PMI index has outperformed in six of the past seven months.6

So, despite the BoE and Bailey regularly talking inflation and recession – how much does this itself feed into the Misery Index? – there are a number of reasons to be cheerful:

1. Firstly, the UK remains an excellent hunting ground for investors, with private equity and overseas investors flocking to snap up undervalued, world-leading UK businesses as seen in the upsurge of M&A activity, in spite of geo-political factors and fleeting macro conditions. In fact, as we read recently in a Times article7: “A private equity investor based in New York, expressed mild surprise that Brits were so bearish about their own economy. Governments come and go, he said. The UK’s advantages – great capital markets, great ecosystem of advisers and lawyers, great workforce, great time zone – were undimmed in his eyes by our myriad current problems”. At the time, 36 UK listed companies were in offer periods, which was the highest number since the start of the Covid pandemic, and since then there have been a further five deals8.

2. Things are not as bad as they seem. Economic PMI indicators for the UK have been sitting stronger than their US and European counterparts, with the UK more favourably positioned in terms of self-sufficiency than other markets. Economies who may have depended on outsourced energy supply in addition to outsourced aggregate demand, military defence and/or monetary policy, for example, are more exposed to the risk of economic and political crisis. Most economies – and not just the UK – are facing a commodity and supply chain shock and cost-of-living crisis, but UK consumers are much less indebted than at the start of Covid with higher aggregate savings, while wage growth remains strong and housing wealth is at an all- time high.

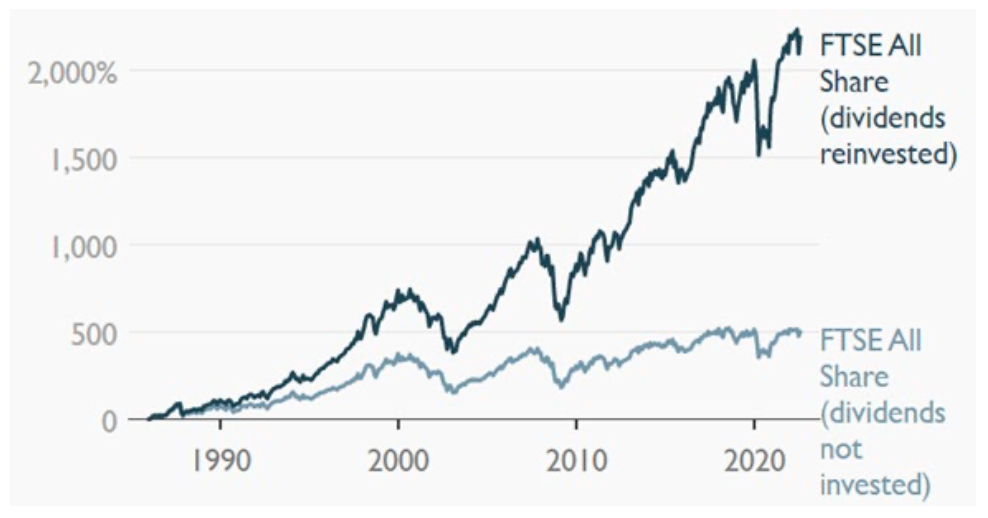

3. The power of reinvesting dividends remains a key attribute of UK equities (Figure 2). This is something that has been forgotten about in the long bull market post the global financial crisis.

Figure 2: the benefits of compounding

Source: Bloomberg, 2022

And if you don’t believe us, we can look elsewhere. As we mentioned earlier, economies which all too willingly relinquish autonomy over their energy, defence and monetary policy are more exposed to the risk of economic and political crisis. As Ambrose Evans-Pritchard wrote in the Daily Telegraph earlier this month9, “Germany in particular has manoeuvred itself into an economic and political crisis of Zeitwende proportions by outsourcing everything: its energy supply to Putin’s Russia, its aggregate demand to Xi Jinping’s China, its military defence to America, and its monetary policy to the ECB … In the lapidary words of Deutsche Bank board member Paul Achleitner, ‘It is not Schadenfreude to point this out’.”

Conclusion

We’ve previously made the case to be constructive on UK equities post-Brexit uncertainty and again after the Covid shock. Now we seek reasons to be cheerful as we face a cost-of-living recession. While market sentiment today seems to mirror that of summer 2020, back before there was any hope of a vaccine, we would note that markets rotate quickly.

As conviction investors, we would caution against the danger of whiplash investing. We are patient enough to continue to concentrate on company fundamentals to target strong, risk- adjusted returns, waiting for the intrinsic value we believe is there to be released. Buying equities involves long-term ownership and quality stewardship, and short-term losses will not fundamentally affect long-term intrinsic value. We want to be there to see this realised.