The macroeconomic backdrop is changing, or at least uncertain. This could shift the pricing of risk assets, but it won’t change what we do, which is look for stronger competitively advantaged businesses that fit our quality growth philosophy

When we invest money on behalf of our clients, we seek superior businesses with durable competitive advantages and commensurate high returns on capital. The aim is that the compounding nature of these businesses builds wealth over the medium and long term.

But not every market participant shares the same goal. Much of the volume in the market is driven by shorter-term traders, many of whom are exploiting strategies they believe can generate return while diminishing risk. Occasionally these strategies can add significant volatility to returns.

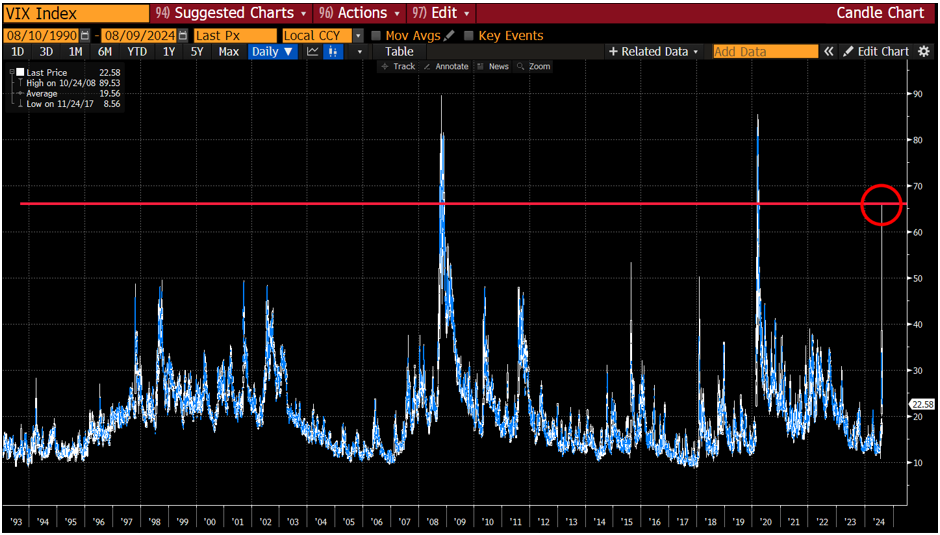

We have just gone through a period where such strategies have been disappointed. The recent spike in volatility in the chart of VIX (the Chicago Board Options Exchange’s CBOE Volatility Index) can be seen as a sign of these strategies being frustrated and closed out on a massive scale (Figure 1).

Figure 1: A spiking VIX

Source: Bloomberg, as at 16 August 2024

Coming back to today, we have just seen a spike in volatility not far short of that seen during the collapse of the financial system during the Global Financial Crisis (GFC) and with the onset of the Covid-19 pandemic. What caused it this time? Apparently, initial jobless claims in the US were a bit higher than expected and suddenly we were heading for recession (subsequent examination of the data showed an increase in the labour force participation rate was to blame).

We live in a capitalist world and as such price is meant to be a signal. So, what has recent price action told us:

- Economic growth is slowing. The odds of recession have gone up, but are still slim.

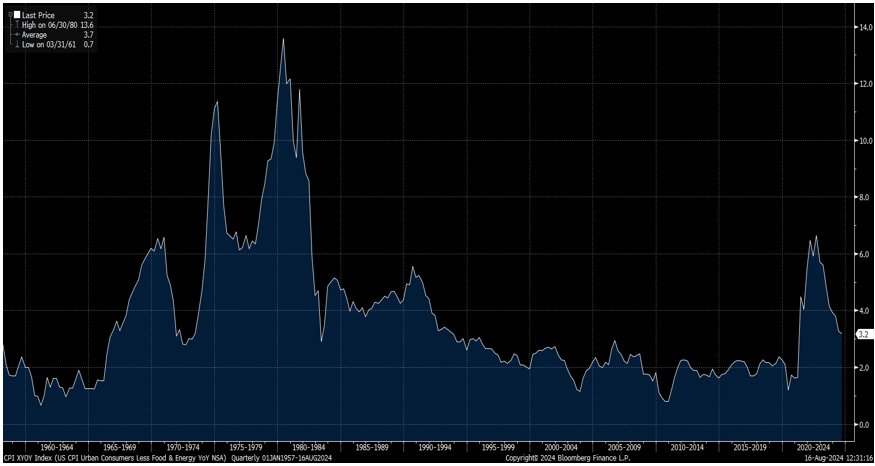

- We are leaving the post-pandemic period of high inflation … at least for now? (Figure 2)

Figure 2: US CPI excluding food and energy

Source: Bloomberg, as at 16 August 2024

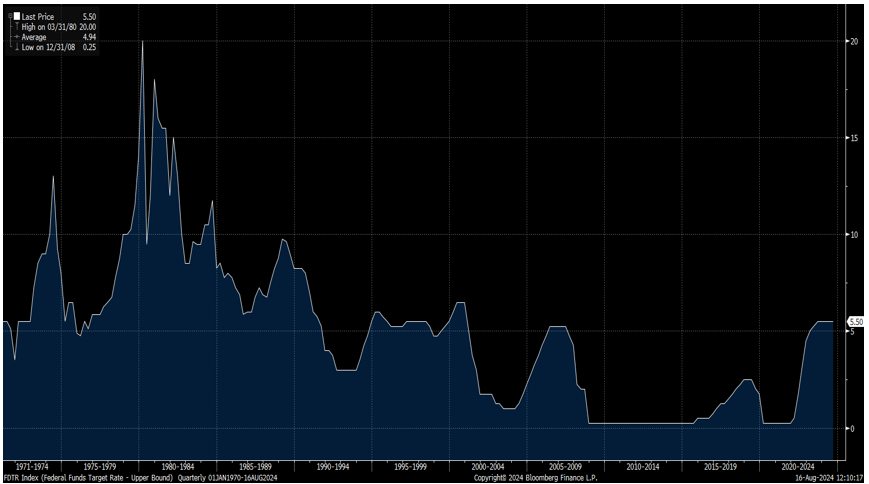

Figure 3: Federal Funds Target Rate

Source: Bloomberg, as at 16 August

Bond yields are reflecting all of this, and the cost of capital is falling. Though the steepening of the yield curve suggests we are not set to go back to the low level of bond yields experienced in the post-GFC period.

Perhaps the biggest signal from recent market movements is that the one-way certainty of the market seen in the first half of this year has reached a pause. The macroeconomic backdrop is potentially changing, or is at least uncertain, and this may change the pricing of risk assets.

If economic growth is slowing, recession risks are rising, inflation is falling, and interest rates and the cost of capital are set to decline, surely those companies that can generate revenue and profit growth against that backdrop are more valuable. This leads us back to the secular trends in the market, the wealth creation by companies exposed to the secular trends but with the competitive advantage to exploit them profitably.

In 1987 the stock market crash did not bring a major change in fundamental trends. After a brief period of accommodation by the Federal Reserve interest rates continued to rise, peaking in early 1989 at 9.75% (a different age). Despite this the S&P hit all-time highs in 1989, although the rising cost of capital did manage to puncture the bubble of the time – the Japanese equity market. My memory is not good enough to remember if there was a change in equity market leadership, but I don’t think there was.

Today, the average company is decently profitable. There is little to be gained from further globalisation, and there are forces in the world – both political and economic – which suggest the trend may reverse. What is driving wealth creation are those companies that can grow by innovation of new products and new ways of doing things that reduce the cost of doing business; or by companies that can aid the process of decarbonising the world – changing the energy source of the world is a multi-decade task and will generate sales growth and wealth for advantaged companies. We have entered an artificial intelligence (AI) era and while the ultimate winners may be uncertain, there are some things we can say with confidence: an AI era is a cloud computing era, and the cloud is dominated by three companies. Growth looks assured and with that oligopolistic market structure wealth creation also looks certain.

Beyond the secular growth opportunities in the market, our research is focused on near-term earnings resilience and the potential in names which may see an improved outlook as interest rates are cut. In our experience, stronger competitively advantaged businesses in any industry often gain market share at a faster pace during tougher economic periods. Ensuring companies genuinely fit our quality growth philosophy is, as always, critical.