Our Return to Normal index

What has changed?

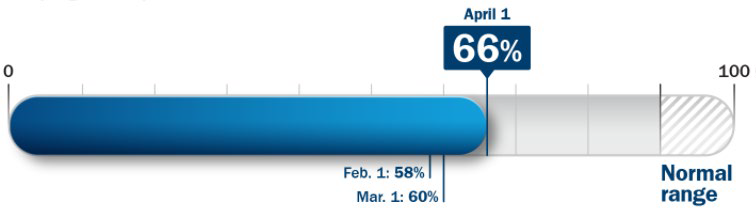

Since our March 2021 update, the Return to Normal Index has climbed to 66% – all of the index components that we track are improving. Drivers of this increase include a broader pool of people receiving vaccines and looser restrictions on many activities. The monthly jump has made it clear that widespread vaccination can fuel behavioural and economic recovery. By May 2021, two more vaccines will probably be approved in the US, enabling supply to meet demand by the end of the second quarter.

Figure 1: The Return to Normal Index tracks activity compared with pre-pandemic levels as we progress to post-Covid life

Source: Columbia Threadneedle Investments, 1 April 2021

What are we monitoring, and where is it at?

Figure 2: Tracking inputs

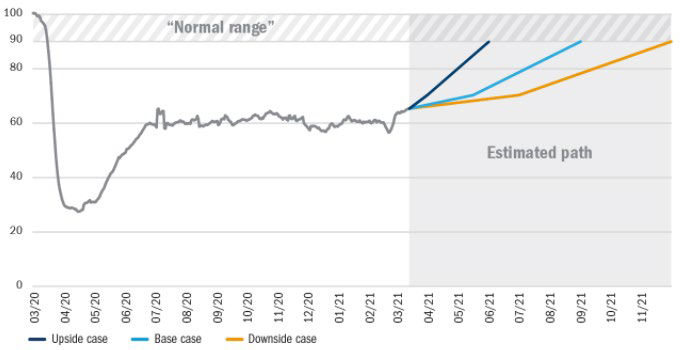

What could drive change?

Figure 3: The Return to Normal Index over time – level as of 1 April: 66%

Source: Columbia Threadneedle Investments, 1 April 2021

Understanding where we are on the path to normal life will be a critical question in 2021. This data can help inform investors’ asset allocation decisions and set expectations on market activity.