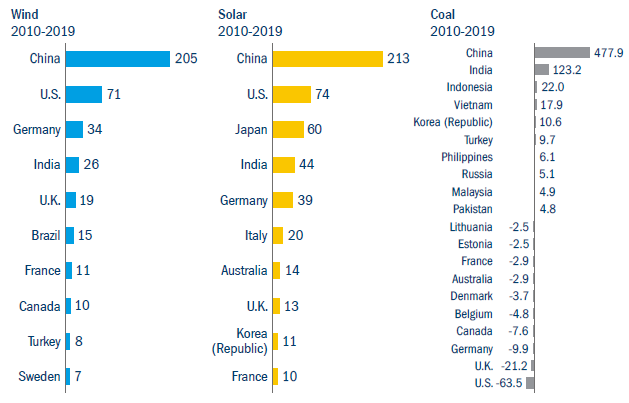

China is a double-edged sword:

it is the world-leading renewables

developer, installing more than

double the gigawatt (GW) capacity of

its nearest competitor over the past

decade both in terms of wind and

solar power (Figure 1), but at the

same time it has seen the highest

coal capacity additions over the same

period – nearly quadruple that seen

in India. The Chinese government

announced it is aiming to reach peak

coal emissions by the end of the

current five-year plan ending in 2025,

but new coal plants with 40-year life

spans do not fit well with a 2060 net

zero emissions target. China is a

country of great progress and great

opportunity, but also of contradictions.

Figure 1: China’s renewable output

Source: Bloomberg New Energy Finance, 2020.

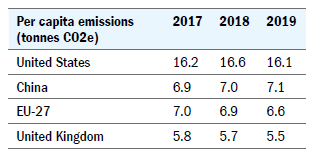

In absolute terms, China is the

biggest contributor to global emissions

– but this is mostly due to its size.

When looking at emissions on a per

person basis it is much lower than the

US and roughly in line with the EU – the

big difference, however, is that after

more than a century of rising emissions,

the EU is now on a downward trajectory

while China’s are not (Figure 2). Another

point to consider with country level

emissions is that these are production based

emissions figures.

Figure 2: Comparing emissions

Source: Our world in data, 2020.

This means that the emissions generated from theproduction of Chinese-made goods

which are consumed in the EU or the

US is captured in China’s footprint.

If we looked at per capita consumption

emissions, China would likely look

much better than the EU, the US and

the UK.

With China’s new net zero targets

and its existing leadership in the

renewables space – the country

produces 70% of the world’s solar

panels, half the electric vehicles

and has a large share of a lot of

the materials that underpin battery

technology – it is unsurprising that

investors have been taking a closer

look at the Chinese renewables

market. Increasing investor attention,

especially from ESG-conscious

investors, has driven a rise in

corporate attention to sustainability

disclosure. The use of forced labour

in supply chains is a particular area

of focus and risk currently.

With China’s new net zero targets

and its existing leadership in the

renewables space – the country

produces 70% of the world’s solar

panels, half the electric vehicles

and has a large share of a lot of

the materials that underpin battery

technology – it is unsurprising that

investors have been taking a closer

look at the Chinese renewables

market. Increasing investor attention,

especially from ESG-conscious

investors, has driven a rise in

corporate attention to sustainability

disclosure. The use of forced labour

in supply chains is a particular area

of focus and risk currently.

Towards the end of 2021 it is

expected that a more detailed

decarbonisation roadmap will be

published. This could solve some of

the coal conundrums and is likely

to focus on three key areas: carbon

pricing, green finance and tech

investment. These developments

have the potential to accelerate the

already bullish scenario.

The market size of the opportunity

is huge. The International Renewable

Energy Agency (IRENA) predict that

by 2050 8,519 GW of solar would

be required in a <2 °C degrees of

warming scenario in line with the

Paris agreement – this represents

an 18x increase on 2018 levels.

Asia, and mostly China, is predicted

to account for more than 50% of total

installed solar power compared to

20% in North America and 10% in

Europe.

With the recent announcements

indicating a step change in the focus

on energy transition, the improving

disclosure standards and the

significant opportunity set, we believe

the Chinese market could be one

to watch. Although, importantly for

international ESG investors, this will

be conditional on ensuring that supply

chains have no exposure to the Uyghur

human rights abuses in Xinjiang.