Filter insights on this page

Capabilities

Media type

Themes

Regions

The summer of discontent rumbled on with the cost-of-living crisis remaining at the forefront as inflationary pressures on food and energy continued to mount

In the UK, we lost our Prime Minister Boris Johnson to further scandal and a leadership race was on; the two remaining candidates showed a markedly different view of how to tackle the pressure the UK was facing. The campaign was largely targeted at a tiny core of Conservative party members, and the policies of Liz Truss in particular were designed to appeal to that group. As was anticipated by the polls, she was duly designated the new Prime Minister, coinciding with the much-mourned passing of a global institution – Queen Elizabeth II. Intending immediately to face up to the challenges confronting the UK economy, the new Prime Minister and her Chancellor of the Exchequer, Kwasi Kwarteng announced a bold plan to decrease taxes and increase spending in order to kickstart productivity – a move that may have been applauded had it not been for the engineered exclusion of the Office for Budget Responsibility, and no clear plan of how to fund this largesse beyond an explosion in the UK’s Government debt burden. Whilst parts of the plan were welcomed, such as that supporting consumers and businesses through the energy crisis, the tax cuts which seemed aimed at the wealthy were not well received and Labour took a significant lead over the Conservatives in poll data.

Of more immediate concern for the pensions industry was a vicious sell-off in UK nominal and real yields (yields rising and gilt prices falling), driven initially by overseas investors shunning the UK and by all investors repricing expectations of central bank rates following the mini-Budget. The real yield on a 30-year index-linked gilt increased by c.2.5% in a matter of days (ratings agencies also took a dim view of the mini-Budget). Whilst the rise in yields was generally positive for pension scheme funding ratios because of any unhedged liability risk, the magnitude and speed of market moves created challenges in recapitalising leveraged LDI portfolios. There are certain mechanical aspects to leveraged exposure – when leverage increases to a level that is deemed uncomfortable either more money/collateral must be found to back it and thus bring the leverage down; or positions must be cut – the latter creates a self-perpetuating cycle in such a market environment, particularly with the poor liquidity seen over this period. Eventually, the Bank of England stepped in on a temporary basis, by delaying the start of their promised Quantitative Tightening (QT) programme and agreeing to buy up to £5bn a day in long dated gilts purely to stabilise the market.

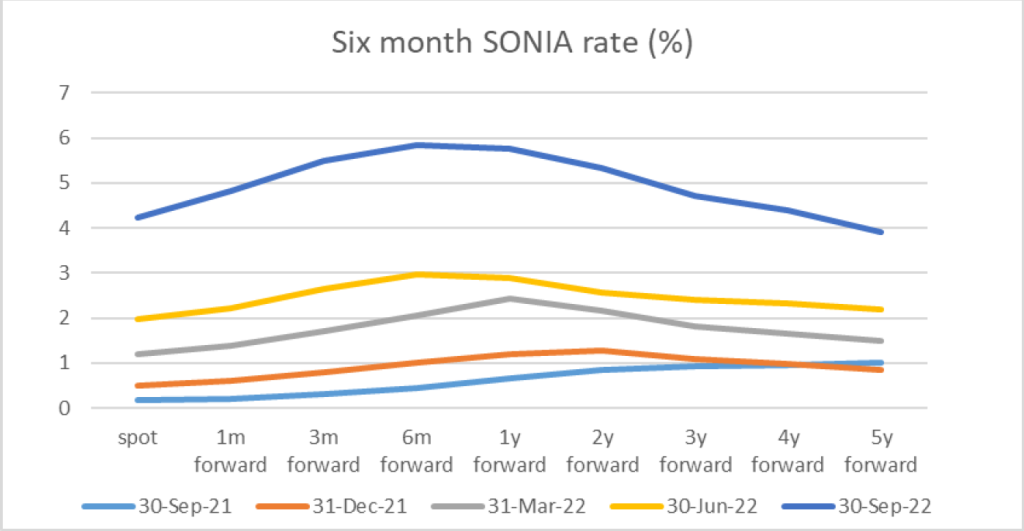

The market’s view of where long-term rates could move to in the future is encapsulated in forward rates. The chart below shows where the six-month SONIA swap rate is currently (spot) and at various forward rates out to five years. As can be seen from the chart below, rate expectations have completely shifted from where they were anchored three months ago, with the peak seen in March 2023 but at a far more elevated level of close to 6%. Note that rates are also predicted to fall sharply post the apex. One-year forward rate expectations have leapt by 2.87% within that same three-month period.

Source: Barclays Live, as at 30th September 2022

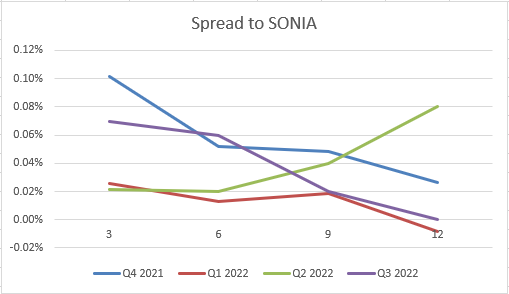

Repo rates are expressed relative to SONIA, and the chart below displays the average repo rates that we have achieved over the past four quarters for three, six, nine and 12-month repos, shown as a spread to average SONIA levels at the time. Almost entirely throughout the third quarter, repo conditions remained easy despite the anticipated onset of QT. However, the market volatility seen towards the end of September has proven challenging for the repo market, dependent as it is on leveraged activity, and conditions have markedly worsened, both in terms of liquidity and price level.

Source: Columbia Threadneedle Investments, as at 30th September 2022

Repo market conditions remained attractive and at a low cost for much of the third quarter, until the Growth Plan and updated remit requirements. The future path of rates is now so unpredictable, even over a three-month time-period, that repo rates as a spread to SONIA have had to increase simply to price in that uncertainty. These increases are likely to be far more prominent over the coming quarter, with the anticipated drop off in repo liquidity into the end of the year, as has been the case for most years barring the prior.

Columbia Threadneedle Investments’ traded repo rates over the third quarter have benefited from the use of ‘special’ bonds for repo with achieved repo rates as low as SONIA – 0.45%. The general rising rate environment also produces a positive outcome as repo trades are typically executed early in the morning, meaning that when compared to end of day rates they are significantly better. These two factors have served to offset the generally higher repo cost as a spread to SONIA, particularly for the longer tenors.

Bilateral repo remains the optimal market access route for liability hedging investors. The recent market volatility and stress seen in the volume of collateral calls have prompted a few bilateral market makers to consider elevating their haircut requirements, typically from zero to perhaps a couple of percent. This compares favourably with an anticipated rise in cleared repo haircuts which are projected to move to over 20% for 30-year plus bonds (the majority of a pension fund’s holdings). The reality is that, in terms of collateral sufficiency, the cost of cleared repo will now be prohibitive. Electronic trading, however, is swiftly becoming the norm due to operational and pricing efficiencies. At Columbia Threadneedle Investments, our repo activity is now entirely managed via electronic platforms, bringing resource benefits to both our clients and our counterparties.

Repo funding generally remains cheaper at this moment for creating leveraged exposure to gilts over the lifetime than the equivalent total return swap (TRS) and so continues to be used within our LDI portfolios and has the advantage of using bond-only collateral or even credit collateral. However, pricing for total return swaps can be very bond specific and, where the bank counterparty can obtain an exact netted position, the rate can be extremely competitive. TRS can be longer dated, with maturities ranging from one to three years and even five years, as compared to repo which typically vary in term from one to 12 months. Hence, TRS can be beneficial for locking in funding costs for longer and for minimising the roll risk associated with shorter-term repo contracts. On the other hand, repo facilitates tactical portfolio adjustments more easily and tends to be slightly cheaper. We ensure portfolios have access to both repo and TRS for leveraged gilt funding, so we can strike the right balance between cost, flexibility, and minimisation of roll risk. It is essential to maintain a range of counterparties to manage the funding requirements of a pension fund. We now have legal documentation in place with 22 counterparties for GMRA (Global Master Repo Agreement) and 24 counterparties for ISDA (International Swaps and Derivatives Association) and more are being negotiated.

Indicative current pricing shows leverage via gilt TRS for a six-month tenor is very bank dependent and can be either 0.10% wider than repo or a similar amount tighter – this typically depends on the bank’s view of the repo market. Another way to obtain leverage in a portfolio is to leverage the equity holdings via an equity total return swap. An equity TRS on the FTSE 100 (where the client receives the equity returns) would indicatively price around 0.23% lower than the repo (also as a spread to six-month SONIA). This is extreme due to the stress seen in fixed income markets currently not spilling over to equities. Clearly, this pricing can vary considerably from bank to bank and at different times due to positioning, which gives the potential for opportunistic diversification of leverage. However, the gilt market stresses we have seen over recent weeks means that, irrespective of any pricing difference between gilt and equity funding, we anticipate increased interest in diversifying leverage between growth and matching exposures going forward.

SONIA – Sterling Overnight Index Average