Ensuring universal access to basic infrastructure and services

The Fund invests in this outcome class to improve transport and communications infrastructure across the UK as well as support development of infrastructure in more economically disadvantaged countries. This is a key sector that drives economic development, particularly in regions where basic infrastructure is lacking.

There is also an increasing need to reduce the environmental impact of the sector through more sustainable development and updating existing infrastructure.

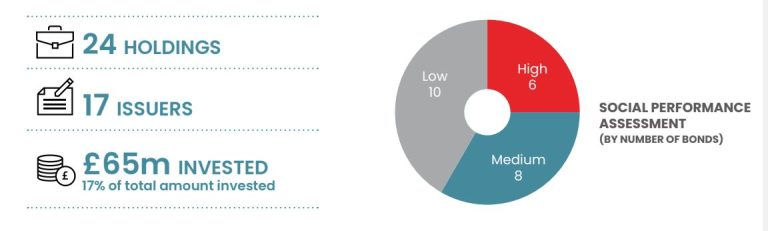

This year, the UK Government issued the UK Green Gilt, which the Fund has invested in (see case study). Other UK holdings held by the Fund include bonds from issuers such as BT, Manchester Airports Group, Eversholt Rail, Network Rail and Motability.

Following on from the two bonds issued by Orange in 2021, the Fund invested in the second sustainability bond from the company. In the last year the Fund purchased a general corporate purpose bond from AA. In 2022, the Fund also holds a sustainability bond from Asian Infrastructure Investment Bank, who are focusing on development outside the UK.

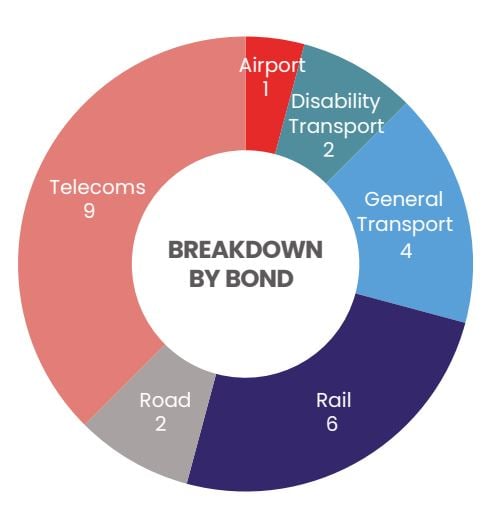

The portfolio remains well distributed across different subsegments, with over half of the holdings in Telecoms and Rail.

Download the full report

Discover how the strategy invests in this outcome class to improve transport and communications infrastructure across the UK as well as support development of infrastructure in more economically disadvantaged countries.