Unloved and undervalued for some time, Japanese stocks have of late been enjoying a surge in inflows from overseas investors including ourselves and one Warren Buffet.

He visited Japan earlier this year and shared in April that he had been increasing investments in the country, notably in Japan’s five largest trading houses known as ‘sogo shosha’ and might add further to his holdings. In our Universal Multi-Asset Portfolios, we have recently moved to an overweight position in Japanese equities.

Foreign Inflows to Japanese Stocks

Source: Bloomberg, Japan’s Ministry of Finance

The swell in confidence for Japan’s equity markets saw the Nikkei 225 enjoy its best month in over two years in May with stocks at one point reaching their highest level in 33 years1. The index outperformed all major global stock indices last month, posting a 7% gain.

Structural change is driving momentum

There are several reasons for the growing tide in investment in Japanese equities. The economic backdrop has improved, corporate investment in reshoring production is increasing and structural reform picking up. Although analysts’ forecasts hover just around a 1% expansion in GDP this year, and this may on the surface appear anaemic, it is a level above Japan’s 10-year average. What is more, after decades of trying, the country is poised to exit from deflation with consumer prices excluding fresh food up 3.4% year-on-year in April – a long-sought after signal of a structural shift in the economy.

The economic improvements foretell better fortunes for businesses and indeed the recent earnings season gave much cause for cheer. Crucially for investors, confidence in the improving outlook and additions to net profits prompted, with a nudge from the Government, Tokyo Stock Exchange and activist investors, an upgrade to shareholder returns.

The earnings season saw several companies provide mid-term management plans (MTMPs) incorporating shareholder returns through dividends and buybacks. Some buybacks were telegraphed, others with the clause “if we have cash”.

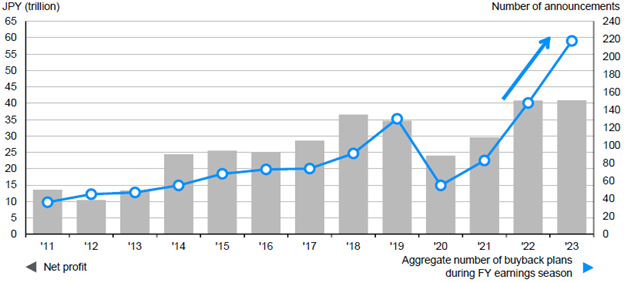

TOPIX aggregate net income and share buyback announcements*

Source: BofA Global Research, QUICK, J.P. Morgan Asset Management.

*Based on TOPIX companies with fiscal year ending in March. Share buybacks aggregated from Apr 1 to May 18 for each year.

Data reflect most recently available as of 24/05/23.

According to Nikkei Asia, by the end of May, companies had set aside a total of over 5.16 trillion yen for share buybacks2. Honda plans to buy back up to 200 billion yen of its shares – about 4% of the total. The buy-back will be invested, the company says, in promoting electrification and raising shareholder returns. Precision machinery manufacturer Ushio also reported an unusually large share buyback of 17% of its shares (excluding treasury stock). Companies’ dividends pay outs were also up, running around 13% higher versus last year distribution. And there change underway to set minimum dividend on equity rather than percentage of profits.

The earnings season has now concluded. Results were not necessarily strong but they were resilient. Sectors that guided for the highest earnings growth were those that benefit from lower materials prices, namely electric power and gas. Meanwhile, domestic demand-led sectors are also on course to benefit from the reopening of the economy post-Covid and a healthy bounce in inbound tourism.

Forces uniting for change

With an ageing population, the Government wants more people to invest in the stock market to fund their retirement. The Tokyo Stock Exchange (TSE) has been supporting the Government in this endeavour. At the end of Q1, it issued a non-mandatory request for listed companies with a P/B ratio (Price-to-Book) below 1 to disclose detailed plans on how they expect to achieve a ratio of 1x or better.

Around half of the large companies in the TOPIX had a P/B ratio of less than 1, which is a loss in the value of capital entrusted by shareholders. Via a ‘name and shame’ approach the TSE is looking to reduce this figure. The major cause of the low P/B ratios is excessive cash on hand. Cash reserves of listed companies, excluding financial institutions, had accumulated to about 100 trillion yen by the end of 2022, according to Nikkei. The prospect of getting a share of that has been a significant enticement for investors.

Not all the excess cash will be distributed to investors of course, elements of it can be expected to be directed towards investment in capital expenditure, research and development and human resources. For the longer-term investor that is also good news. Worries that the rally in Japanese equities may overextend in the short term are emergent on the horizon but the ongoing inflows from offshore investors suggest stocks shouldn’t suffer any setback for long. And while Japan’s low absolute interest rates, in a globally rising rates environment, have set the yen on a gentle trajectory of weakness over the past few months, the tailwind for overseas earnings is slight and even if interest rates remain low on an absolute basis, the currency could strengthen if yield curve control is removed.