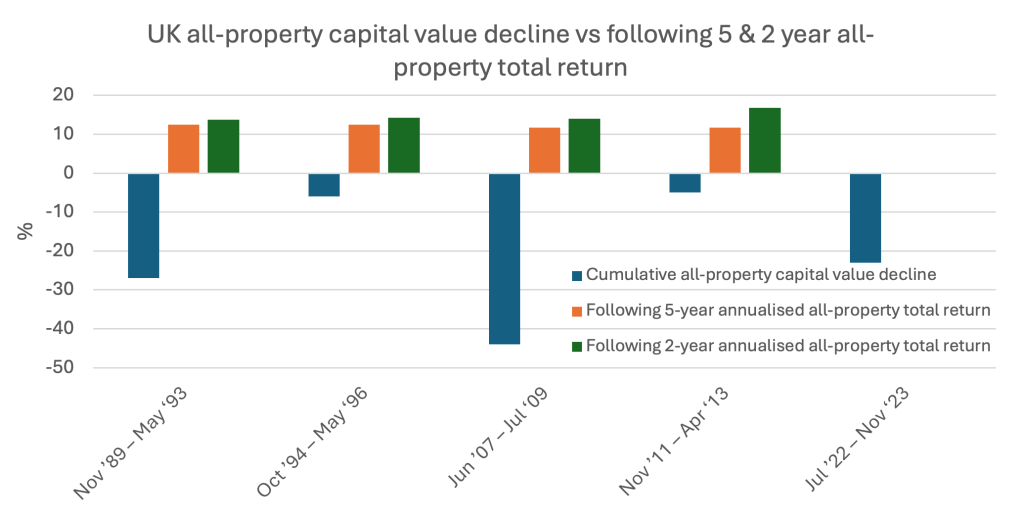

Again, this in itself is not unusual; the base rate has averaged around the 3.1% mark over the last 30 years3. Nor is it to say that the outlook for the sector can’t be positive. In the last five economic downturns, UK real estate has delivered double digit annualised returns in the two and five years that followed (see chart)4.

However, real estate needs to work harder to offer an attractive risk premium. With limited headroom for capital growth through yield compression at the market level, the financialisaton of real estate has ended and we are back to fundamentals; income as the engine of performance and stock selection the driver of relative outperformance.

In this context, we believe achieving outperformance will be more nuanced than in the previous cycle. Portfolios need to be aligned with sectors offering scope for growth. At the same time, they need to hold property assets that have the scope to turn this potential into performance. As a result, when selecting properties for our portfolio we need to consider two key aspects to deliver an enhanced return – allocating to the right sectors and finding buildings within them that are functionally relevant.

Sector allocation

Functional relevance

The ability to do this relies on asset fundamentals and functional relevance. Real estate is a physical asset and therefore not only needs to be central to the occupier’s operations today, it needs to evolve to remain so. The factors influencing this including the quality of accommodation, flexibility of the structure, resilience and growth potential of the location and the residual value attached to the land.

Balanced Commercial Property Trust has maintained a strategic commitment to high quality assets in core locations, supporting our ability to execute value-accretive asset management. This is exemplified by our refurbishment and repositioning of a logistics holding at Strategic Park, Southampton, a strategy conceived to strengthen the asset’s income profile, capital value and ESG credentials.

The project completed in October 2023 and was fully leased by March 2024. The initiative has delivered strong financial returns, securing rents at a 27.5% premium to the previous passing rents and generating a capital return of 15.7% over the last 12 months9. Alongside this, the project incorporated ESG enhancements including A-rated EPCs, BREEAM ‘Very Good’ certification and a full solar photovoltaic system installed on the roof, which is forecast to deliver an additional income return of circa 7.5% per annum.

Discrete Company performance (%) | 31/12/23 | 31/12/22 | 31/12/21 | 31/12/20 | 31/12/19 |

|---|---|---|---|---|---|

NAV TR | -3.3 | -9.2 | +18.9 | -8.1 | -2.1 |

Share Price TR | -12.5 | -11.7 | +37.8 | -28.3 | -2.4 |

Proactive asset management across the BCPT portfolio has unlocked inherent rental growth opportunities to deliver a 5.3% increase in income over the course of 202310, in addition to driving the capital growth currently absent at the market-level. Combined with continued active and opportunistic management, we endeavour to maintain our track record of long-term portfolio outperformance.