Invest smarter

for your future

Discover how we can help you invest for the future

you want

Assessing the impact of the US tariff announcements: Columbia Threadneedle’s Global Chief Investment Officer and Global Head of Equities have provided their views on the potential impact of the US tariff announcements, along with some insight into how we factor the tariff changes into our approach. You can read the article here.

Whatever future you imagine, your investments should help make it possible. At Columbia Threadneedle Investments, we provide a range of investment options to suit investor needs.

Our Savings Plans allow you to invest through a range of investment trusts and you can find out more about them on the dedicated Savings Plans area of the website. We also have a wide range of other investment options, you can find more about them here.

Our CT Savings Plans

Securing your future needn’t be a challenge. Our Savings Plans can help, with investment options from as little as £25 per month or £100 by lump sum. You can invest in a range of investment funds.

Getting started is easy

3 Steps towards

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

All of our savings plans involve a level of risk and the value of your investments can go down as well as up. The level of risk will depend upon the underlying investments that you choose to hold in the plans. You need to be comfortable that you may not get back the original amount invested. Tax allowances and the benefits of tax-efficient accounts are subject to change and tax treatment depends upon your individual circumstances.

Choose Columbia Threadneedle

There are lots of reasons to choose Columbia Threadneedle, here’s a few:

- All our saving plans allow you to take advantage of our investment trusts

- With our investment trusts, you’ll have access to a diversified and professionally run portfolio of shares, no matter how much you invest

- Our range of trusts give you plenty of choice. You can invest in a specific region or assets like property, equities, bonds and private equity.

- We can trace our investment roots back to 1868, when F&C Investment Trust, the world’s oldest collective investment fund launched, and have been adding to our offering ever since.

Explore our investment trusts

Find out all you need to know about our investment trusts. Each of them caters for different aims & has a different approach, giving you an opportunity to diversify your investment portfolio.

Our other investment options

Columbia Threadneedle has a comprehensive range of investment funds catering for a broad range of objectives. Explore our range of OEIC and SICAV funds.

Want to know more about Investment Trusts?

If you’d like to find out more about investment trusts, the Association of Investment Companies (AIC) has lots of useful information. Whether you’re new to investing or looking for advice on what to consider when choosing an investment trust, you’ll find it here.

Invest now

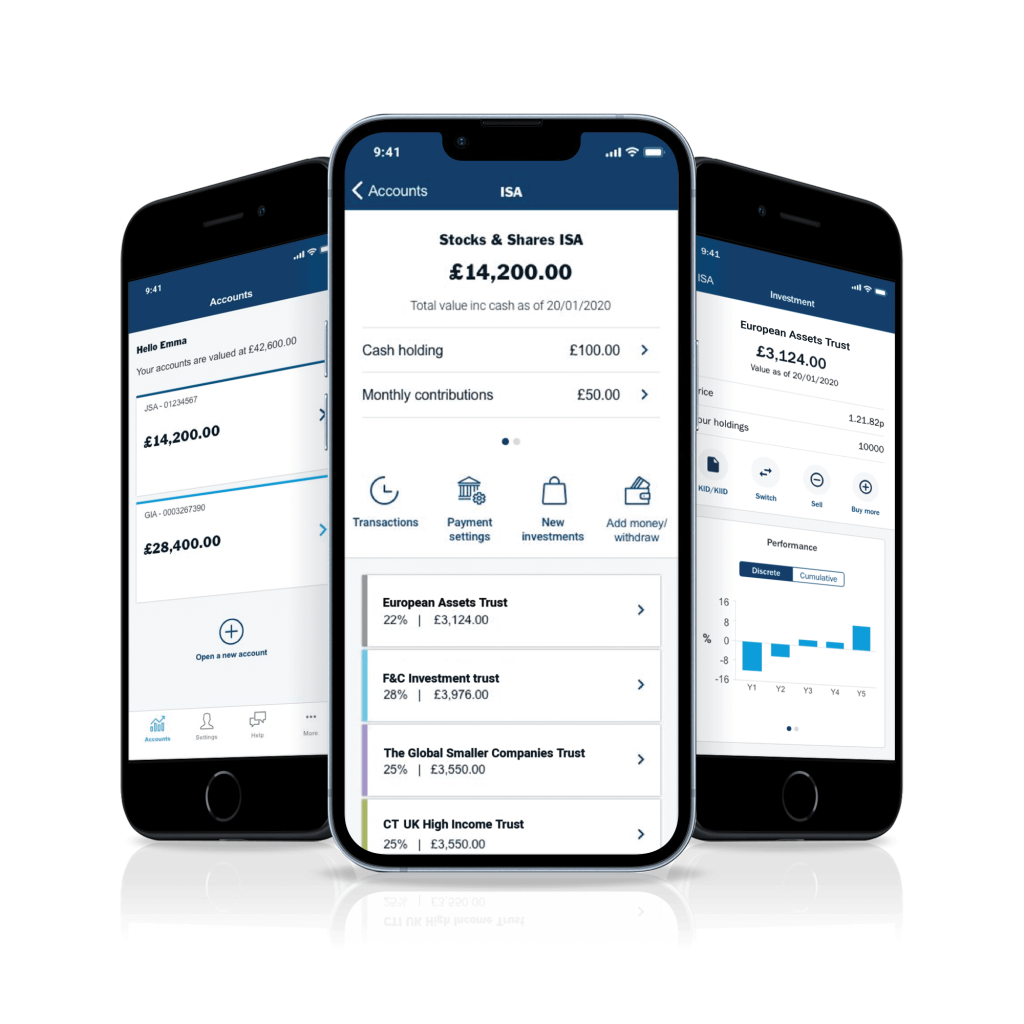

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.