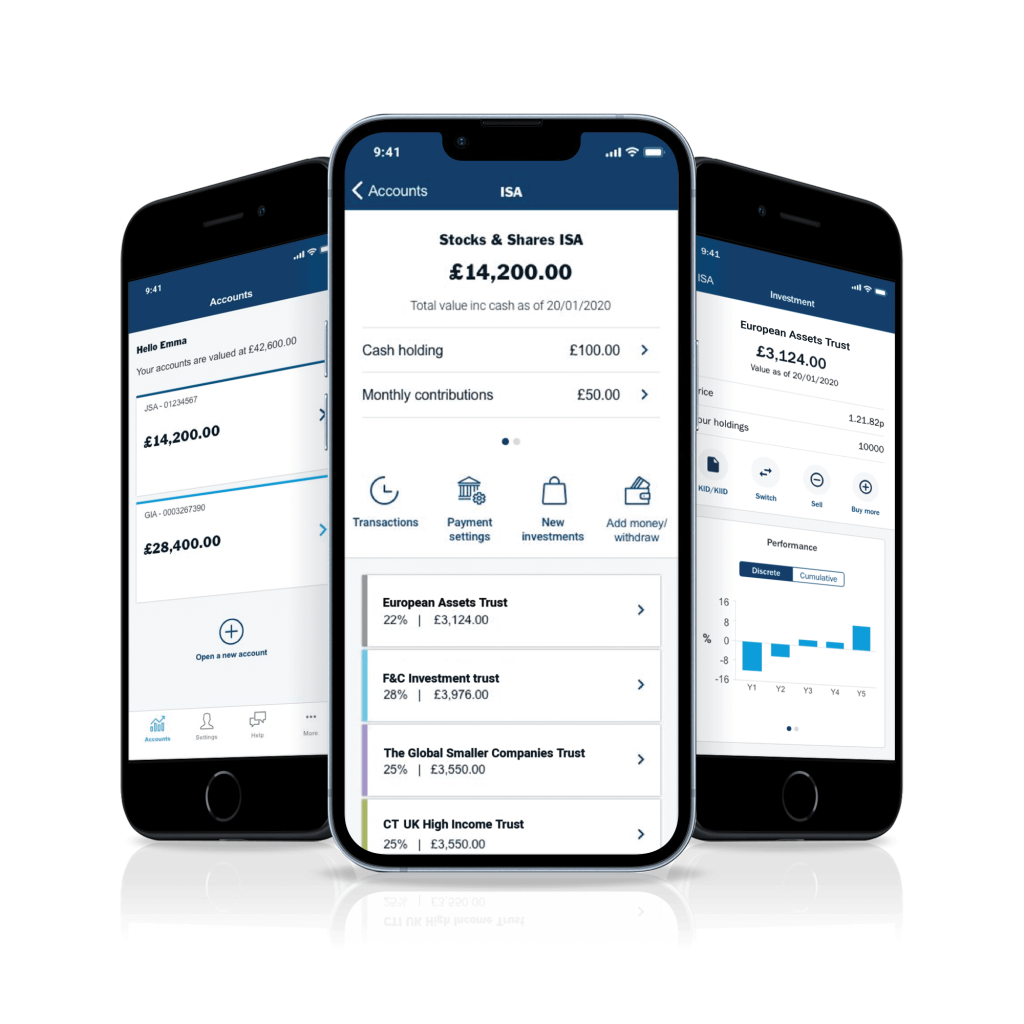

CT Individual Saving Account

Tax efficient saving. Open or switch your ISA today.

Individual Savings Account (ISA) explained

An Individual Savings Account (ISA) is an account that acts as a wrapper to hold savings or investments. ISAs allows you to invest up to £20,000 in the 2025/26 tax year, with no tax on any growth or dividends paid. At Columbia Threadneedle, we offer a stocks and shares ISA.

The right ISA for you depends on your goals and your attitude towards risk. The CT ISA lets you tap into the potential of the stock market and the skills of our fund managers to potentially help your investments grow over the long-term.

CT Savings Plans can help longer-term investors that intend to keep their money invested for at least five years. The opening investment amount of £2,000 for a CT ISA helps ensure investors with smaller sums to invest can get value for money and reduces the risk they receive a poor financial outcome.

Reasons to choose Columbia Threadneedle for your Stocks and Shares ISA

No online dealing charges

Benefit from our expertise

Responsible Investing

Investment Trust options

Getting started is easy

3 steps towards

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

There’s an element of risk involved with a stocks and shares investment ISA. The value of your investments can go down as well as up and you may get back less than you originally put in. You need to be aged 18 or over and be a UK resident, and you should consider this as a longer-term investment. Tax allowances and the benefits of tax-efficient accounts are subject to change and tax treatment depends upon your individual circumstances. Columbia Threadneedle Management Limited is authorised and regulated by the Financial Conduct Authority and assets are protected by the Financial Services Compensation Scheme.

A cost-effective way to invest

Our CT ISA features a flat annual fee of £60 + VAT (£72), regardless of how much you invest. A Government stamp duty of 0.5% applies on the purchase of UK shares.

You can start investing in a CT ISA with an opening investment amount of £2,000. Once you have deposited the opening investment amount, a Direct Debit can be arranged from as little as £25 a month. You can also make one-off investments at your convenience from £100.

Accounts can be opened online or by post and an application form is located in the Document Library.

There are no dealing charges payable for Direct Debits or online one-off contributions, sales, and switches. If you send instructions in the post, there is a £12 charge for each fund selected.

Please read the pre-sales costs disclosure, Key Features Document and Terms & Conditions before you invest. You will need to sign a declaration on our forms that confirms you have read these documents.

Transferring your ISA to Columbia Threadneedle Investments

Switching your ISA to us is easy, all you need to do is complete a transfer form and we will take care of the rest. The process can take between four and six weeks.

If you’re looking to transfer money you’ve invested in an ISA during the current year, you must transfer all of it.

For investments you’ve made in previous years, you can transfer some or all your savings.

Your ISA transfer should be for £2,000 or more. CT Savings Plans can help longer-term investors that keep their money invested for at least five years. The opening investment amount of £2,000 for a CT ISA helps ensure investors with smaller sums to invest can get value for money and reduces the risk they receive a poor financial outcome.

Invest in a CT ISA through our investment trusts

With a CT ISA you invest through our diverse range of Investment Trusts. Our Investment Trusts provide a range of investment opportunities, including access to equities, bonds, property and private equity.

Each trust has different aims and strategies. You can select a trust that aims for capital growth, income or both. Some have a specific regional focus, while others take a global approach.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start investing from £2,000 for an adult account and £1,000 for a child account. Regular monthly contributions can be made from £25 or one-off additional investments from £100 after the minimum opening investment has been made. There are no dealing charges when you deal online.

Top 5 frequently asked questions

You can have as many ISAs as you like, and you can pay into as many as you wish in the same tax year. Please note even if you have more than one account your overall allowance is still £20,000 per tax year (allowance correct for 2024/25 tax year). For example, you could invest your full £20,000 allowance in a Stocks and Shares ISA or split it between two stocks and shares ISAs and a Cash ISA.

Payments are normally made from the ISA account holder. We can accept payments from third parties however we will require a letter, signed by them and sent along with the payment, that confirms that the money is being irrevocably gifted to the ISA account holder. We may also be required to verify the identity of the payer (for example, a certified copy of their current passport or driving license for identity and a copy of a bank statement or utility bill as proof of address). If someone else is planning to make a payment into your ISA you may want to contact our Investor Services team (0345 600 3030 or +44 1268 447 407 if you’re overseas, lines are open weekdays 9am-5pm) in advance of the payment being sent to check if anything further will be required.

Yes, you can do this by simply completing our General Investment Account (GIA) transfer of sale proceeds to ISA form. This will mean your shares will be sold and the proceeds used to buy shares within an ISA account in your name.

As the account holder (you can only have one account holder for an ISA) you can top up through the online Investor Portal using a debit card. Alternatively, you can send us a cheque in the post along with the relevant Top-Up Form.

Your money is invested on the next available dealing day after receipt of your payment (subject to online dealing cut-off times, up to 11:59pm).

The proof needs to be pre-printed by your bank and show:

- Your sort code

- Your account number

- The name of the account holder(s)

This is normally a pre-printed pay-in slip (which is usually found in the back of your cheque book but may be provided by your bank/building society separately) or cancelled cheques (i.e. a blank cheque that you have scored through so that it cannot be used). A cancelled cheque is sometimes referred to as a spoilt cheque or a voided cheque.

There is no tax to pay on any return on your investment, including dividends or interest received. You’ll also pay no capital gains tax (CGT), which may be relevant if you have used up all your annual CGT allowance.