CT Junior Investment Account

Give your child a head start with our CT JIA, with no annual investment limits.

As children grow so can their savings

Tap into the global stock market using a CT Junior Investment Account (CT JIA), and build a head start for the child in your life’s future.

Our CT Junior Investment Account (CT JIA) provides an affordable way for parents and grandparents to build a savings pot for their little ones without any investment limits. A great option if you’ve already maxed out a Junior ISA or CTF. Unlike our other two children’s plans you decide when to gift the money to them.

Reasons to choose Columbia Threadneedle for a CT Junior Investment Account

No online dealing charges

Benefit from our expertise

Responsible Investing

Investment Trust options

Getting started is easy

3 steps towards

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Columbia Threadneedle Management Limited is authorised and regulated by the Financial Conduct Authority and assets are protected by the Financial Services Compensation Scheme.

A cost effective way to invest

With a CT Junior Investment Account you invest through our diverse range of investment trusts. Our investment trusts provide a range of investment opportunities, including access to equities, bonds, property and private equity.

Each Trust has different aims and strategies. You can select a Trust that aims for capital growth, income or both. Some have a specific regional focus, while others take a global approach.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest in our Investment Trusts through a CT JIA

Invest from as little as £25, with no dealing charges on investments made by a monthly direct debit. One-off contributions, sales and switches can be made online without any dealing charges. If you need to send instructions via post, there will be a £12 charge for each fund selected.

There’s an annual charge of £25 + VAT for the CT Junior Investment Account and Government stamp duty of 0.5% applies on purchases of UK shares.

Make sure you read the pre-sales costs disclosure before you invest.

Invest now

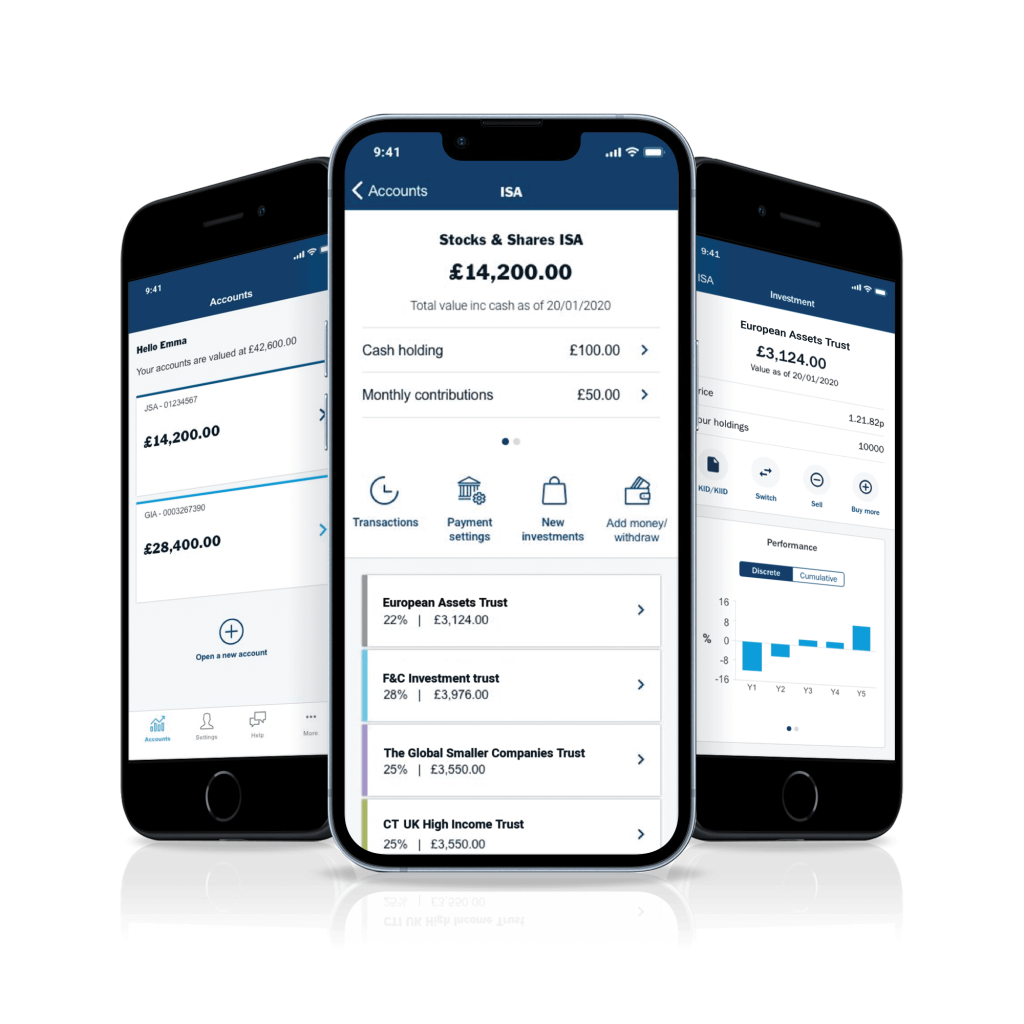

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Frequently asked questions

Complete flexibility – unlike the Junior ISA and Child Trust Fund (CTF) there’s no investment limit and you can decide when you gift the money to the child. Once you set up the account you may designate the account to the child/name the child as the beneficial owner. You can also make withdrawals related to the child, making it ideal for childcare costs, school trip funds or even school fees.

Maximise your inheritance tax advantages – grandparents who are saving for their grandchildren can reduce their inheritance tax (IHT) liability as sums gifted to the child are free of IHT if the donor lives for seven years after making the gift.

Retaining ownership means you can keep control of your investments and access the money before your child reaches 18.

This flexibility means you can use it for day-to-day expenses, like school fees, sports equipment or other necessities. The plan is held in your name with the child’s name as a designation. This will usually be done by putting their initial on the account name. You can then transfer the account into your child’s name when they are 18, or you can decide to keep it in your name.

Junior Investment Account – Gifting ownership

By deciding to give ownership to the child, the funds are given to the child now. However, as children under 18 cannot be the legal owner of an account, you can appoint up to four adults to look after the investment on behalf of the child. This has the benefit that it would not form part of your estate for inheritance tax purposes. You will not be able to access the money as the assets belong to the child.

However, withdrawals can be made for the child’s expenses. If you’re a trustee you’ll have legal control over the plan until the child reaches legal capacity. That is 18 years old in England and 16 years old in Scotland.

Anyone can open a CT Junior Investment Account, not just the child’s parents.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.