CT Lifetime ISA

Get a head start on buying your first home or save for your retirement, with a 25% government bonus on your yearly contributions of up to £4000

Lifetime Individual Savings Account (LISA) explained

A Lifetime ISA can be opened by people aged 18 to 39 to help towards a first home or retirement. With a Lifetime ISA, you can invest up to £4,000 in the 2025/26 tax year and the government will give you a 25% bonus up to £1,000.

It acts as a wrapper to hold a range of different investments. The right Lifetime ISA for you depends on your goals and your attitude towards risk.

Reasons to choose Columbia Threadneedle for your

CT Lifetime ISA

No online dealing charges

Benefit from our expertise

Responsible Investing

Cost-effective Investing

Getting started is easy

3 steps towards

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

There’s an element of risk involved with a Lifetime ISA. The value of your investments can go down as well as up and you may get back less than you originally put in. You need to be aged between 18-39 and be a UK resident, and you should consider this as a longer-term investment. Tax allowances and the benefits of tax-efficient accounts are subject to change and tax treatment depends upon your individual circumstances.

Any withdrawals made from your Lifetime ISA that are not for an eligible house purchase or retirement when you are 60 years old will incur a Government withdrawal charge of 25% which means you could get back less than what you put in.

A cost-effective way to invest

Invest from as little as £25, with no dealing charges on investments made by a monthly direct debit. One-off contributions, sales and switches can be made online without any dealing charges. If you need to send instructions via post, there will be a £12 charge for each transaction, for each fund selected.

There’s an annual charge of £60 + VAT for the CT Lifetime ISA and Government stamp duty of 0.5% applies on purchases of UK shares.

Make sure you read the pre-sales costs disclosure before you invest.

How to open a CT Lifetime ISA

Choose the Investment Trust(s) that best suits your investment needs and finally, decide how much to invest. Please make sure you read the Key Features and Terms & Conditions, the relevant Key Information Document and Pre-Sales Disclosure documents.

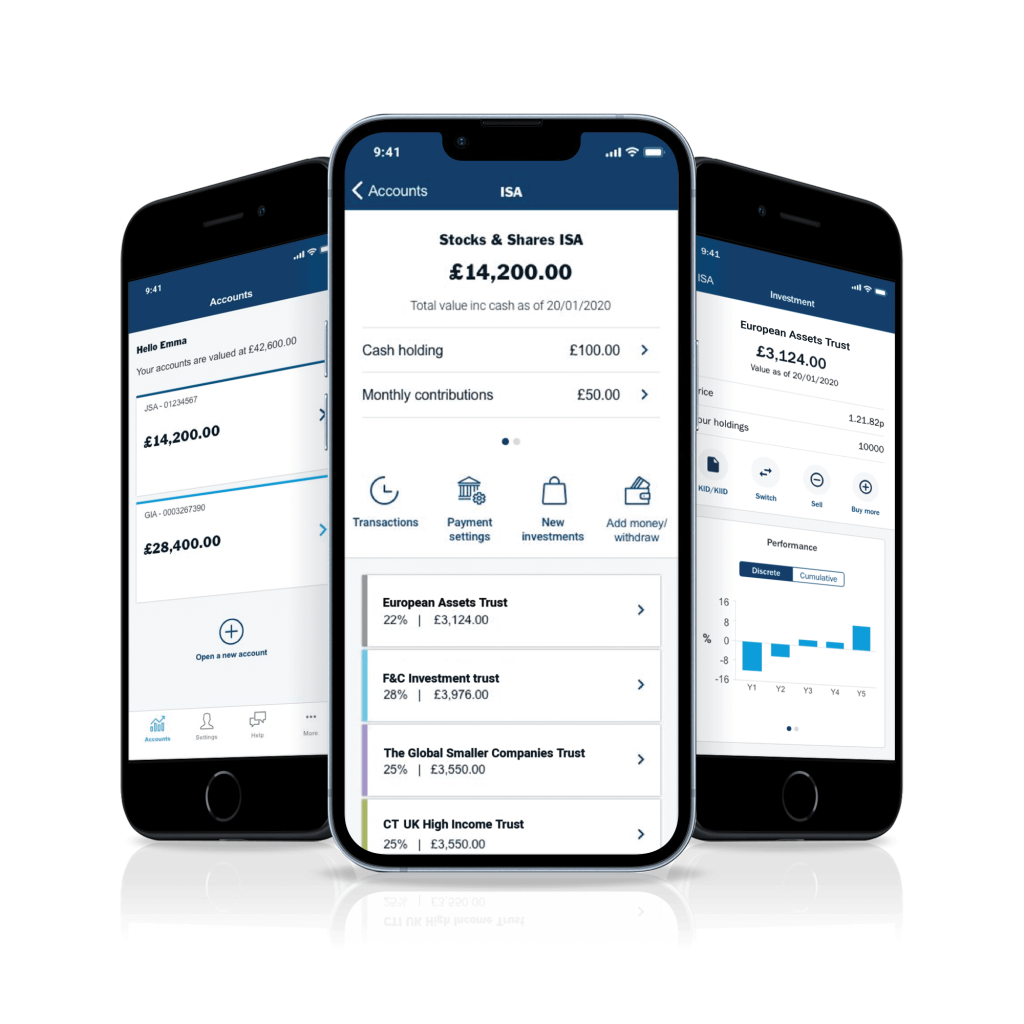

Our Investor Portal is the quickest and most cost-effective way to invest. You can set-up a monthly direct debit or invest a lump sum using your debit card. Alternatively, you can download an application form and send it into us.

Invest in a CT LISA through our investment trusts

Choose a CT LISA to invest in our diverse range of investment trusts. Our investment trusts provide a wealth of investment opportunities, including equities, bonds, property, and private equity.

Each Trust has unique goals and strategies. Choose a Trust focused on capital growth, or aim for income, or one that covers both. Some invest in specific regions, while others take a global approach, and invest in companies all over the world.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Frequently asked questions

You can have more than one Lifetime ISA account, but you can only open one in each tax year and put money into one account each tax year.

Payments are normally made from the Lifetime ISA account holder. We can accept payments from third parties however we will require a letter, signed by them and sent along with the payment, that confirms that the money is being irrevocably gifted to the account holder. We may also be required to verify the identity of the payer (for example, a certified copy of their current passport or driving license for identity and a copy of a bank statement or utility bill as proof of address). If someone else is planning to make a payment into your Lifetime ISA you may want to contact our Investor Services team (0345 600 3030 if you’re calling from the U.K. or +44 1268 447 407 from overseas, lines are open weekdays 9am-5pm) in advance of the payment being sent to check if anything further will be required.

Yes, you can do this by simply completing our General Investment Account (GIA) transfer of sale proceeds to Lifetime ISA form. This will mean your shares will be sold and the proceeds used to buy shares within an ISA account in your name.

There is no tax to pay on any return on your investment, including dividends or interest received. You’ll also pay no capital gains tax (CGT), which may be relevant if you have used up all your annual CGT allowance.

As the accountholder (you can only have one account holder for an ISA) you can top up through the online Investor Portal using a debit card. Alternatively, you can send us a cheque in the post along with the relevant Top-Up Form.

Your money is invested on the next available dealing day after receipt of your payment (subject to online dealing cut-off times).

The proof needs to be pre-printed by your bank and show:

- Your sort code

- Your account number

- The name of the account holder(s)

This is normally a pre-printed pay-in slip (which is usually found in the back of your cheque book but may be provided by your bank/building society separately) or cancelled cheques (i.e. a blank cheque that you have scored through so that it cannot be used). A cancelled cheque is sometimes referred to as a spoilt cheque or a voided cheque.

There is no tax to pay on any return on your investment, including dividends or interest received. You’ll also pay no capital gains tax (CGT), which may be relevant if you have used up all your annual CGT allowance.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.