The Asia-Pacific region’s

e-bike industry is ideally

placed to be a driving force

in the electric revolution

globally

Tesla’s stock surged to record levels,

Geely-owned Volvo announced

an all-electric fleet by 2030 and

Volkswagen AG publicised plans for

six new battery plants by 2025.

All these recent business headlines

reflect the growing momentum of

everything “e(lectric)-mobility”.1

Although intriguing, these

developments represent only a

fraction of a much bigger and

more complex global equation,

encompassing technical innovation,

climate change, urban development,

sustainability, government policies,

change of consumer behaviour

and much more. Electric cars may

dominate the headlines, but they

are not leading the transition to

electric vehicles.

Why? Cost and infrastructure

issues are still plaguing electric

cars’ broad adoption. Instead,

two-wheel vehicles like electric

bicycles (e-bikes), electric scooters

(e-scooters), electric motorcycles

(e-motorcycles), and micro-mobility

devices are leading the way.

When it comes to the number of

vehicles on the road, electric twowheel

vehicles are way ahead of

their four-wheeled counterparts.

It is not in the metropolises of North

America or the major cities in Europe

where electric vehicles are making

the biggest headway – it is in Asia

and more specifically, China. In the

UK, there are some 140,000 electric

vehicles today – quite a surge from

just 3,500 in 2013, but in China,

22.7 million of them were sold in

2018 alone – more than in the rest

of the world combined.2

The surge of e-bikes is going

beyond China. India, Indonesia,

Vietnam, Thailand and other Asian

markets are embracing electric two

wheelers at scale. While the rest of

the world is taking their first steps

to an electric vehicle future, Asia is

already walking at pace. Extending

from its already impressive base,

the Asia-Pacific market for e-bikes

is expected to grow at a CAGR of

10.1% between 2020 to 2027 and

to reach US$10.26 billion by 2027.3

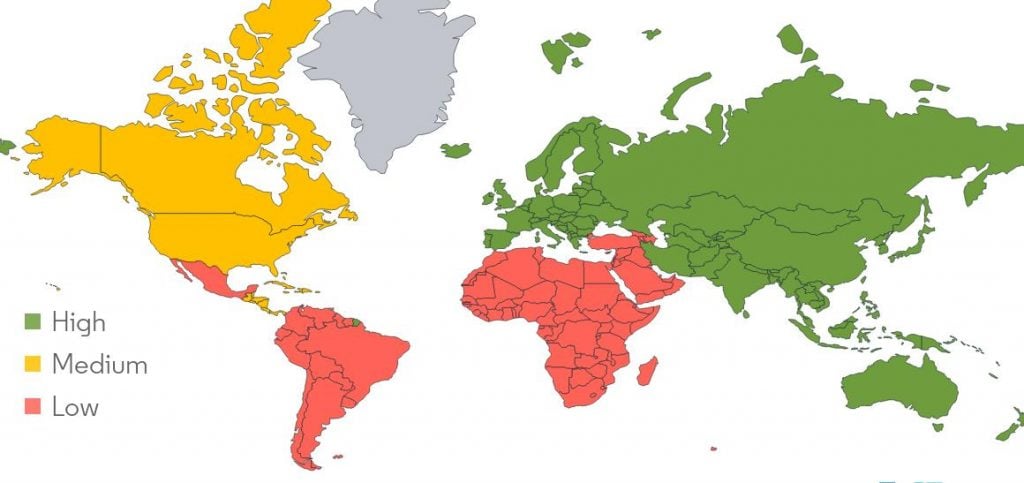

Figure 1: E-bike market – growth rate by region (2021-2026)

Source: Mordor 2020.

The other main growth area is

Europe, with the Netherlands and

Germany currently leading the

charge. More than 40% of the

bicycles sold in the Netherlands last

year were electric. In Germany, a

third of the 4.3 million new bicycles

sold had a battery, according to the

country’s industry association.4

An important consumer market,

the Asia-Pacific region also is a

production hub for e-bikes and

related components, like battery

cells and charging infrastructure.

Opportunities for investors

With major suppliers like Bosch,

Liv Cycling (EnergyPak), Panasonic,

Samsung SDI, and Shimano Inc.

commanding more than 70% of

the global market for e-bike battery

packs, the segment is moderately

consolidated. But there are still

exciting opportunities for investors.

The e-bike battery pack market offers

a dynamic growth outlook with a

predicted compound annual growth

rate of 13% for the five-year period

ending in 2026. Commitments

like Samsung SDI’s plan to invest

US$1.15 billion into battery production

capacities in Xian and Tianjin, China

are testament to that potential.5

Closely connected to power cells is

the market for charging equipment.

The market is young, and its

potential is largely untapped as

yet. Critical areas like speed of

charging to reduce vehicle downtime,

improved convenience from wireless

and on-demand mobile charging,

more efficient charging through grid

and renewables integration are some

of the opportunities. Innovations

in these areas are just beginning

to emerge and their broad scope

creates a highly diverse market with

hundreds of competitors.

It should come as no surprise that,

in addition to native players like

Merida, Shimano or Samsung,

international players are also

strengthening their presence in the

region. Bosch eBike Systems for

example opened its new Asia-Pacific

headquarters in Taichung, Taiwan

in 2020. It is the latest milestone

in a continually growing footprint in

Asia-Pacific, after successful market

entries in Australia, Japan and New

Zealand within the last six years.6

Continental also has corporate

offices in China, South Korea and

Vietnam.

Companies which are successfully

competing in the e-bike market

already are enjoying the benefits.

Giant Manufacturing, the US$4 billion

Taiwanese group, saw revenue jump

55% year-on-year in June 2020.

Accell, the US$730 million parent to

brands such as Raleigh and Sparta,

earned more than half its revenue

from e-bikes last year.7

Other companies outside the core

bike industry are taking note and

trying to hop on the bandwagon.

Traditional car and motorcycle

manufacturers are among them.

General Motors (GM), Ford Motor

Company in partnership with Pedego,

Peugeot, Volkswagen, Ducati Motor

Figure 1: E-bike market – growth rate by region (2021-2026)

Source: Mordor 2020.

Holding in partnership with Thok,

all introduced e-bike offerings of

some sort in the last two years.

Jeep unveiled its efforts as part of a

2020 Super Bowl advertisement, the

most expensive TV advertising time

available in the US.8

The appeal goes beyond the

immediate, established players

within the mobility sector though.

The technological advances brought

about by e-bikes have given other

industries, as well as private and

institutional investors, food for

thought.

The future of e-bikes

Where the bicycle’s design has

arguably remained constrained to

a dual triangle frame and a pair of

wheels for most of its existence,

the e-bike provides the opportunity

to create a gadget which can build

in software appeal and tech-ready

hardware.

This explains the attraction for

Foxconn Technology, the main

assembler of Apple products, who

has joined forces with a fellow

Taiwanese hardware firm, Yageo

Group, to delve further into electric

vehicle production.9

It is part of the rationale as to why

Groupe Bruxelles Lambert (GBL),

which owns the lion’s share of

Adidas, took a controlling stake

in Canyon Bicycles in late 2020.

Joining GBL as an investor is Tony

Fadell, a former Apple executive,

renowned for his work inventing the

iPod and NEST (the temperaturecontrol

device). One of Canyon’s

most recent projects was a prototype

for an “electric pedal car”, which was

rumoured to now receive significant

funding following the acquisition.10

Investors are betting on the

continuation of this growth trend.

Shares in Giant Manufacturing have

risen 43% so far this year and are

now valued at 26 times Daiwa

Capital Markets’ forecast earnings

for 2021. Shimano, the US$19 billion

Japanese group which controls

roughly half the global market for

bicycle components, trades on

a forward multiple of 35 times,

according to Refinitiv data.11

In summary, the Asia-Pacific region

is in a prime position to not only

benefit from continued sales

growth in the e-bike sector, but also

harness significant investment and

innovation. We’re looking forward

to seeing where e-bikes will take

investors in the coming years.