Solutions: Enhanced

Introduction

The methods that insurers use to report profit to shareholders and solvency to regulators have been changing. This is the result of new accounting standards and solvency capital regulation in many markets.

This has meaningful Asset Liability Management (ALM) implications for insurers. ALM has long been a key consideration within insurers’ asset strategies, driven by the economic characteristics of business lines. But while jointly managing assets and liabilities has always made sense, the move to market-related measures of assets and liabilities brings increased clarity and new objectives to consider. An ALM decision to align asset performance more closely with moves in liabilities often involves foregoing potential return in order to reduce volatility in earnings or in the balance sheet position. But it also has a second, and sometimes more important, impact: a reduction in the capital an insurer needs to support its balance sheet risks. This means that insurers now more than ever need to be transparent about their ALM strategies and understand the multiple impacts of their choices.

At Columbia Threadneedle, we have been collaborating with clients to customise portfolios for more than 20 years. We have a strong conviction in our track record of building sophisticated investment solutions, from liability matching to growth strategies and regulatory-sensitive insurance mandates.

A few themes have emerged from our work with insurers as together we have been analysing and implementing ALM changes in this new environment:

- Immunisation and multiple discount rates. A core ALM approach is to immunise portfolios from movements in interest rates by aligning the duration of assets and liabilities. This approach is complicated when accounting and solvency regulations use different discount rates. Should assets seek to immunise the solvency or the accounting balance sheet? What impact do different choices have? Analysis must embrace an insurer’s broader situation – there is no single right solution.

- Trade-offs when building matching credit portfolios. Insurers with long-tail liabilities (e.g. annuities) will typically back these with bond portfolios whose cash flows match the liabilities. They expect to hold these bonds to maturity, so can be relaxed about changes in credit spread – variation for which other investors would normally demand a premium. They therefore expect to earn a significant fraction of the credit spread as excess return. Modern solvency regulations support this by specifying how to reduce the value of liabilities but impose conditions on how the portfolio is managed. Insurers must tread a delicate path between maximising the liability-reduction and holding bonds which maximise longterm return while remaining within the regulatory constraints.

- Hedging process design and documentation. Hedging assets against potential drawdowns can be a critical contract feature. But getting capital relief and ensuring that accounting for the hedge aligns with the underlying assets is important too. Insurers need to determine if they are happy to constrain their hedging design choices to meet the rules laid down by regulators.

Reporting rules are tightening

New international accounting standards IFRS 9 (financial instruments) and IFRS 17 (insurance contracts) govern public reporting of the asset and liability sides, respectively, of insurers’ balance sheets (see Appendix). In parallel, regulatory reporting, focused on solvency, has been changing. Solvency 2 came into force in the European Union in 2016 and overhauled how much capital insurers are required to hold against their liabilities. In broad terms, this introduced market-consistent valuation of future liability cashflows as well as a standard approach to calculating how much additional capital should be held against future events that could result in higher outgo. Many other markets have also implemented changes in recent years: the Swiss Solvency Test (SST), the China Risk Orientated Solvency System (C-ROSS) are other prominent examples.

In this article we look at how reporting rules have developed and why they are tightening, and how insurers can approach investment decisions in the new ALM landscape.

Aligning the recognition of asset and liability moves in reporting statements

Insurers will often implement an ALM policy seeking to ensure that changes in liabilities resulting from the use of up-to-date discount rates and changes in the market value of the assets backing these liabilities, offset each other – or perhaps are a source of additional profit (i.e. assets with a credit spread over the liabilities). However, under IFRS171, the default approach is for asset and liability changes to be recognised in two different income statements: assets in the profit and loss statement (PL), and liabilities in other comprehensive income (OCI). This can produce volatility in reported income numbers even if they offset each other in aggregate.

The new international accounting standards are alive to this problem. Alternatives to the default accounting treatments allow insurers to align asset and liability recognition under IFRS 17. A series of interlinked choices must therefore be made – an accounting treatment must be selected for each asset and also for each portfolio of insurance contracts. Insurers do not have complete freedom in making these choices – the standard circumscribes these with a series of tests that must be passed before a specific option becomes available. These include an SPPI (Solely Payments of Principal and Interest) test (i.e. does the asset solely pay back principal and interest) as well as a business model test (insurers must consider the detail of their ALM policy, and potentially provide historical evidence of its operation).

If these tests are failed, then the choices do not arise – the default approach of recognising asset moves in the profit and loss statement must be used. Careful design of the ALM strategy is therefore needed to make sure that the appropriate tests are passed, and then making the corresponding asset classification choices to allow this volatility to be controlled.

Dealing with immunisation and multiple discount rates

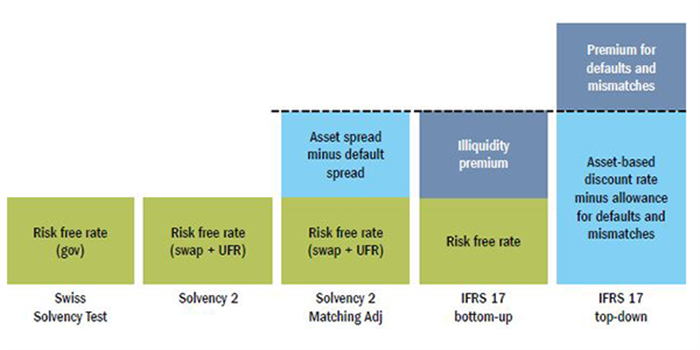

Against this background, how do insurers deal with immunisation and multiple discount rates in investments? The discount rates used for solvency and regulatory reporting will very likely not coincide. Figure 1 illustrates some of the different rates that a European insurer might face, with a similar situation in other regimes.

Figure 1: European insurance rates

Risk-free rates are the starting point for discount rates in a market-consistent valuation framework, although a choice of what constitutes ‘risk-free’ must be made. The Swiss Solvency Test derives risk-free rates from government bond prices – in contrast, Solvency 2 derives them from swap rates combined with an assumed Ultimate Forward Rate (UFR).

Many solvency regimes allow liabilities which are closely matched by an asset portfolio to be valued using a discount rate equal to the portfolio’s yield minus an allowance for defaults. Whereas the regulatory calculation is typically inflexible, insurers have more freedom under IFRS17. In principle this can allow discount rates to be aligned but in practice insurers may need to provide evidence that the assumptions embedded in the regulatory calculation meets the demands of the accounting standard.

The two bars on the right illustrate the two discount rate approaches under IFRS 17. A top-down approach subtracts an amount representing defaults and asset-liability cash flow mismatches from the yield on a portfolio. A bottom-up approach adds an allowance for illiquidity to risk-free rates. These may in principle end up at a similar level (as shown by the dashed line) but the difficulty of estimating the various components makes this unlikely in practice.

Different discount rates mean that durations are slightly different, so ALM policies must determine:

- Asset mix. Changing the mix of credit ratings may help to reduce the difference between discount rate measurements – but this may have implications for long-run profitability;

- Target duration. Choosing to minimise volatility in reported earnings or in solvency measurements will often result in volatility in the other. A middle path may be appropriate. Again, the duration choice has long-run implications beyond any short-run reporting impact.

As highlighted above, asset classification choices may mean that an insurer is unable or unwilling to completely bring reported moves in assets and liabilities into alignment. ALM choices must therefore be made in this wider context.

Trade-offs when building matching credit portfolios

Several global solvency standards allow insurers two major benefits in cases where liabilities are closely backed by an asset portfolio:

- Liability reduction. The value of liabilities is calculated using an additional spread which reflects the credit spread on the backing portfolio minus an allowance for defaults; and

- Capital reduction. To reflect the lower exposure of the net asset-liability position to credit spread movements, the solvency capital requirement (SCR) is reduced.

To qualify, an insurer must ringfence the assets, and closely match asset and liability cash flows. The opportunity cost of accepting these constraints – not being able to actively manage the portfolio, to express views on yield curve moves – must be judged against these benefits but for long-duration business where ALM is already a key consideration, the gains often outweigh any potential losses.

A number of approaches could be taken to building this portfolio:

- Risk/return optimisation. This would take account of market yields and risks but since the capital benefits are not considered explicitly, opportunities to reduce capital that may involve only a small increase in risk are missed.

- Capital/return optimisation. The problem here is that capital rules are often rigid, based on a simplified model, and therefore an imperfect measure of risk. Investment decisions should incorporate a clear-eyed view of the assets, not naïvely accept externally generated measures, as has been emphasised in recent regulatory statements2. An optimiser will allocate preferentially to assets which are viewed as riskier by the market (and so offer a higher return) but not by the capital rules. The resulting portfolio will be concentrated into the corners where risk and capital are furthest apart rather than being diversified across many sources of return.

- Risk/return/capital optimisation. This considers both long-run benefit (return) and short-run benefit (capital reduction) and seeks a trade-off between these and risk.

In our work with insurers, we strongly prefer the final of these three approaches. Such a holistic view is needed to avoid the problems of the preceding two approaches. Of course, the relative weighting of return and capital will depend on each insurer’s circumstances – in particular, on their solvency position.

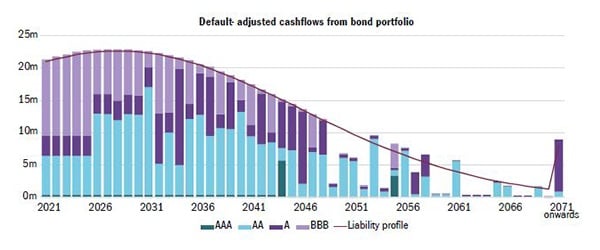

Figure 2 details a portfolio that illustrates these trade-offs and the results of our approach. Whereas capital-only optimisation can lead to riskier rating bands becoming concentrated at specific maturity dates where the capital rules most differ from current market rates, a diversity of credit ratings at each duration is a welcome consequence of the inclusion of market risks into the optimisation.

Figure 2: Adjusted cashflows from bond portfolio

Multi-asset risk hedging

Asset liability management is not restricted to fixed income: duration doesn’t capture all the market risks on an insurer’s balance sheet. Hedging some of these risks is usually clearly in the interests of both policyholders and insurers. The case for additional benefits – in the form of lower balance sheet volatility and a reduction in the capital needed to be held against these risks – is becoming easier to make as reporting standards have evolved. For example:

- Hedging embedded contract options. The dynamic hedging of embedded options helps to manage risks, for example in participating contracts with an overriding guarantee. Accounting for moves in the liability value, an underlying portfolio and the hedging portfolio requires care if these moves are not to appear in different income statements. The risk mitigation option in IFRS17 is an example of how new standards seek to assist this process. Even so, constraints occur: policies must be documented and implemented using derivatives; credit risk management is out of scope.

- Tail risk management. Capital is held against tail risks – e.g. against ‘1 in 200’ events under Solvency 2. To the extent that tail risks can be reduced through static or dynamic asset allocation, required capital should be lower. Some regulators have been willing to take hedging programs into account when determining capital. Again, it is therefore likely to be worthwhile making sure that the ALM strategy is formally documented and justified in order to achieve these benefits.

Managed volatility has been a popular example of the tail risk management in recent years. These strategies dynamically allocate to reduce risky-asset exposure in times of heightened market volatility. Policyholders benefit from a smoother return experience; lower drawdowns and a lower cost of guarantees linked to the investment performance.

Conclusion

Jointly managing assets and liabilities has always made sense for insurers, but the moves to market-related measures of assets and liabilities brings increased clarity, and new objectives to consider, when designing ALM programs. The short-term impact of insurers’ ALM considerations is now much more visible, not just in terms of balance sheet volatility, but also in terms of how much capital they must hold.

This paper has described several key areas that merit closer attention:

- Different discount rates for accounting and solvency reporting means that rate immunisation policy may need to consider trade-offs between these regimes;

- ALM policy documentation, instrument selection and asset classification choices can all have a role in unlocking options to reduce volatility in reported earnings;

- Asset allocation can produce short-term capital benefits but optimising for capital alone is unlikely to produce reasonable portfolios from a risk/return perspective. Carefully designed optimisation can produce portfolios that generate attractive returns and reduce capital without taking undue risks.

In our view, risk taking in investments should be intentional, and sized according to its reward, in the context of other risks being taken in a portfolio or on a balance sheet. An insurer’s ALM decision thus often involves a three-way trade-off: between risk, reward and capital. It may be tempting to optimise for capital reduction in isolation, but this often means seeking gaps or inconsistencies in complex regulatory rules – finding investment opportunities which involve more risk than the regulations recognise. The result? Taking too much risk for too little return. This is rarely a good idea: it is important in our view to keep an eye on all three perspectives.

Appendix

IFRS 17: some key changes

IFRS 17 is a long, detailed standard, but for the purposes of this paper we highlight a few features:

- Economic valuation of liabilities, using discount rates based on the characteristics of the liabilities rather than based on the expected return on the backing assets;

- Current market yields are used for valuation rather than historic yields; and

- Profit emergence is more regulated: a Contractual Service Margin (CSM) is set up at the inception of a product to avoid a day one profit, and then released steadily over the product’s life.

IFRS 9: some key changes

IFRS 9 is also long and complex – here we highlight some features related to profit recognition:

- Asset classification has been refreshed, with hold-to-maturity (HTM) replaced with amortised-cost and available-for-sale (AFS) replaced by fair value through other comprehensive income (FVOCI) but with historic OCI gains and losses no longer recycled through P&L on an asset’s sale;

- Fair value with moves recognised in the P&L statement (FVPL) is the default classification method. A business model test (e.g. will asset be held to maturity?) and asset-characteristics test (are payments purely interest and principal repayment?) determine if alternative methods are allowed;

- Classification choices can be made to reduce mismatches: where several are possible, insurers are able to choose the measurement approach that enables asset and liability moves to flow through the same income statements.

New solvency standards: common elements

Solvency 2, ICS 2.0 and new risk-based capital (RBC) standards in Asia share many features:

- Liability valuation is primarily carried out using best estimate assumptions and using yields derived from bond prices (sometimes with an ‘ultimate forward rate’ for extrapolating beyond the point where these bonds are liquid)

- Capital requirements are based on applying a series of stresses (to rates, credit spreads, equity values etc) to the balance sheet, with a degree of diversification between these different risk factors

- Matching adjustment:where a fixed income portfolio is being held on a buy-and-maintain basis to match closely the cashflows in a specific book of liabilities, a part of the portfolio’s credit spread can be used to reduce the value of the liabilities; capital requirements are also reduced due to the reduced exposure of the asset-liability net position to movements in credit spreads.

The matching adjustment is not used universally – e.g. the Swiss Solvency Test (SST) and China Risk Oriented Solvency System (C-ROSS) do not include this feature.