Responsible business

Responsible investor

We strive to be responsible stewards of our clients' assets within a framework of good governance and transparency

At Columbia Threadneedle Investments, we strive to be a trusted partner to our clients and responsible stewards of their assets, allocating capital within a framework of robust research and good governance in accordance with their investment objectives. Our core business is the active management of clients’ investments through the well-researched allocation of capital to companies and other assets in a manner designed to create long-term value, support economic growth, and serve broader prosperity.

Responsible Investment (RI) is central to our values as an organisation. Our history in RI1.1 spans four decades, and we are proud to have been at the forefront of many pioneering industry developments such as becoming a founding signatory of the United Nations Principles for Responsible Investment (UNPRI) in 2006.

The PRI frames our approach globally and we conform with its core Principles. As a signatory we are assessed annually on how we incorporate ESG issues into investment practices across asset classes.

Principles for Responsible Investment (PRI) 2021 rating

Source: PRI, July 2021. Signatory assessments achieved from applicable assessed indicators, calculated as total points achieved/total points available (only considering indicators relevant for the signatory) in the module. The above assessment does not include modules where the assets were below the threshold defined by the PRI and the assessment of our indirect sub-advisory business.

1 The business formerly known as BMO GAM EMEA was part of BMO GAM at the time of becoming a signatory. The BMO GAM EMEA business was acquired by Ameriprise Financial, Inc. in 2021 and is now part of the global brand Columbia Threadneedle Investments.

PRI ratings

Module name | Columbia Threadneedle score |

|---|---|

Strategy & Governance | A+ |

Listed Equity – Incorporation | A+ |

Listed Equity – Active Ownership | A+ |

Fixed Income – Sovereign, Supranationals and Agencies | A |

Fixed Income – Corporate Financial | A |

Fixed income – Corporate Non-Financial | A |

Key industry associations

- Founding member of the United Nations-backed Principles for Responsible Investment (PRI).

- Active participant in a range of key industry initiatives including Investment Association committees, ICMA’s Social Bond Principles, SASB working groups, PLSA Stewardship Advisory Group.

- Commercial partnerships with Big Issue Invest, INCO, Carbon Trust and Sustainalytics.

Our Responsible Investment Approach

ESG factors are therefore embedded into our fundamental research process, led by a team of approximately 200 analysts and research associates. Working collaboratively across all major asset classes, the team turns information and data into forward-looking insights that can add real value to our investment decisions, enhancing our ability to deliver on our clients’ desired financial and non-financial outcomes.

Our more than 40 RI specialists act as a hub of expertise3. These specialists work with our research and investment professionals to enrich their understanding of key sustainability trends as they relate to specific sectors and issuers. The specialists collaborate with our portfolio managers and investment analysts to highlight risks and opportunities within industries and sectors, informing investment decisions across asset classes.

Visit the Responsible Investment section of our website for more information.

2 While ESG research is made available for use in the investment selection, portfolio managers make their own investment decisions, consistent with portfolio and client mandates, and accordingly certain teams may place more, less, or no emphasis on ESG factors.

3 Includes the history of all entities under the Columbia Threadneedle brand. While ESG research is made available for use in the investment selection, portfolio managers make their own investment decisions, consistent with portfolio and client mandates, and accordingly certain teams may place more, less, or no emphasis on ESG factors.

Active ownership

Columbia Threadneedle Investments offers its clients an investment approach that embodies active ownership. As active owners, proactive engagement (dialogue) with the issuers we invest in on behalf of our clients is an integral part of our approach to research and investment, and as stewards of client capital. Through constructively encouraging investee companies to improve, active ownership can be a powerful driver of positive change, underpinning our commitment to deliver long-term returns for our clients. We engage to enhance our research insights, to deepen relationships with the companies we invest in, and to influence for change over time.

We identify ESG issues of strategic importance to companies we invest in and their wider impact on the world, and ensure an informed approach to our engagement, underpinned by collaboration across asset classes and thematic and sectoral disciplines. We use escalation tools where necessary. It can take time to build consensus for change within a business and to develop the tools to do so. We support companies on that journey, and we hold them to account on their commitments.

Stewardship at a glance

Our Stewardship Report provides a review of our active ownership activities as a responsible steward of client capital.

Managing real estate responsibly - our five-stage approach

Key to our approach is an understanding of the environmental and social risks posed by real estate assets. We focus on mitigating those risks and seeking continuous improvement by assessing the environmental and social impacts throughout the lifecycle of our property assets. This approach is ingrained within the day-to-day activities of our business.

1. Property investment (asset acquisition)

Our fund managers carry out forensic due diligence and comprehensively survey all properties considered for acquisition. They look at factors including energy performance/MEES (minimum energy efficiency standards), environmental risks/impact (including flood risk), and areas for potential improvement in terms of sustainability performance.

2. Strategic asset management

Our asset managers develop unique strategies to add value to every building we manage. They consider areas including environmental, energy and water efficiency, waste management and sustainability best practices. They also look at ways to promote health and well-being and community engagement. Finally, our asset managers seek opportunities to promote information sharing and co-operation with tenants, to enable sustainability strategies to be jointly implemented by the occupier and the management team.

3. Refurbishment and building improvement

Refurbishments carried out by our asset managers offer the greatest potential to improve the environmental and social impact of our buildings. Our Refurbishment Guide promotes high sustainability standards, and construction projects incorporate a set of minimum requirements relating to: environmental management; building quality and flexibility; health and well-being; energy efficiency; transport; water; building materials; waste management; and ecology and pollution.

4. Property management

We are active managers who seek to continually improve the day-to-day environmental impact of our buildings while maintaining high levels of occupier satisfaction and engagement. This is achieved by dedicated Oversight Managers who collaborate with third-party managing agents to deliver objectives aligned to clearly defined targets set out in our Sustainability Road Map. Oversight Managers are also responsible for monitoring health and safety on all our properties, ensuring oversight through monthly reporting, meetings, and independent annual audits.

5. Risk and governance

Our Real Estate team benefits from rigorous risk and governance controls. We have an integrated Real Estate Governance team providing ‘first line’ risk and governance oversight. The team also has a liaison function with Group Investment and Operations Risk and Compliance (‘second line’ functions), and with Audit (‘third line’) as required. Our investment and management process controls are also independently audited on an annual basis as part of our company’s ISAE reporting obligations.

4 Sustainable real estate investment: Implementing the Paris Climate agreement – an action framework, PRI, 2016

https://www.unpri.org/property/sustainable-real-estate-investment-implementing-the-paris-climate-agreement/138.article

5 Source: https://gresb.com

Net zero in UK real estate

We know we must play a role in reducing the impact of our real estate portfolio on the environment – on behalf of ourselves, our investors, our occupiers and our communities.

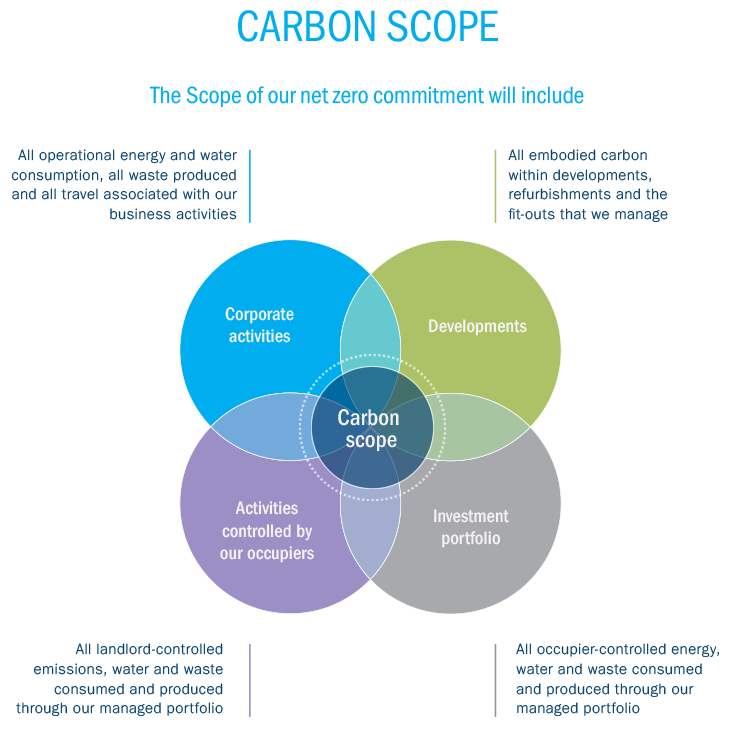

To do this, we have made the commitment to achieve net zero carbon across our UK real estate portfolio by 2050 or sooner. This commitment goes beyond our landlord operations, covering whole building emissions, including our occupiers’. Each fund will set interim targets to measure and drive our progression towards the ultimate 2050 target.

Given the nature of real estate and its diverse stakeholders, we know we cannot achieve this alone. We have created a framework under which we are engaging with our investors, occupiers, property managers, environmental advisers and our supply chain to create sustainable long-term value.

Working together we have the skills and effective partnerships to set clear targets, plans and procedures. This collaborative approach underpins our primary objective to deliver strong investment returns for our clients by enhancing the underlying real estate assets, thereby reducing energy consumption, carbon emissions and running costs.

6 As at 31 December 2022