Should fixed income investors reposition given recent markets shifts?

The year started with some sharp moves in fixed income, with developments in terms of inflation trends and labour market conditions. So, how does this align with our broader fixed income outlook for the year?

Don’t overreact, we’re still moving in the right direction

The US Federal Reserve’s focus on a handful of indicators leading into December 2024 suggested that inflation in North America was becoming sticky. This concern has been on and off the table several times since last year. During the first quarter of 2024 the market got very worked up when the pace at which inflation was declining slowed. Inflation ultimately continued to trend lower, which enabled the Fed to cut for the first time in September. The moral of the story is that markets can be overly optimistic about the inflation trajectory one minute, and then not optimistic enough the next. Markets have a way of swinging to extremes like that.

What indicators suggest inflation will still move lower?

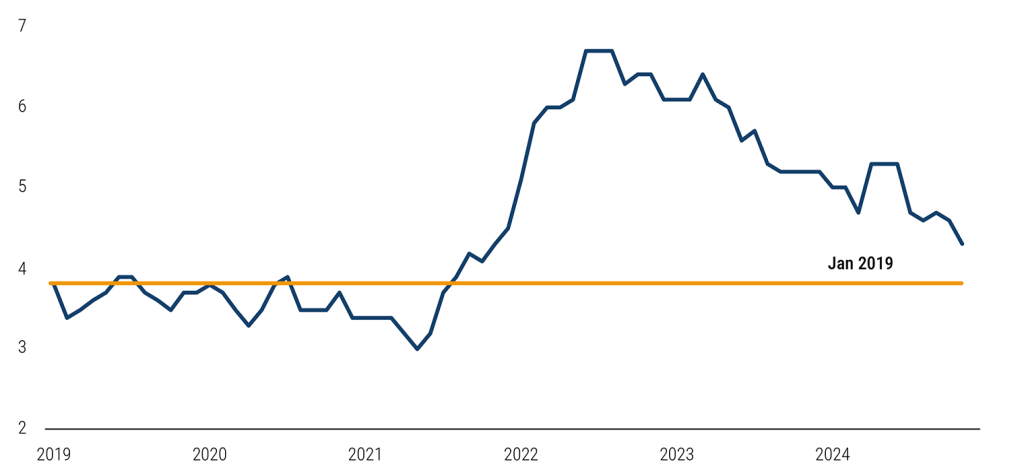

One of the critical indicators is wage growth. Historically, wages have been a durable pass-through mechanism into inflation. When employers pay more to attract labour, they pass those costs on to consumers, creating a cycle of rising prices. Wage growth has been steadily declining for more than two years (Figure 1), and the Fed has acknowledged that wages are not fuelling inflation today.

Figure 1: Trending down - Wages continue to soften

Atlanta Fed's wage growth tracker (%)

Source: Federal Reserve Bank of Atlanta, as of 15 January 2025. The Atlanta Fed’s wage growth tracker is a measure of the nominal wage growth of individuals. It is constructed using microdata from the Current Population Survey (CPS) and is the median percent change in the hourly wage of individuals observed 12 months apart.

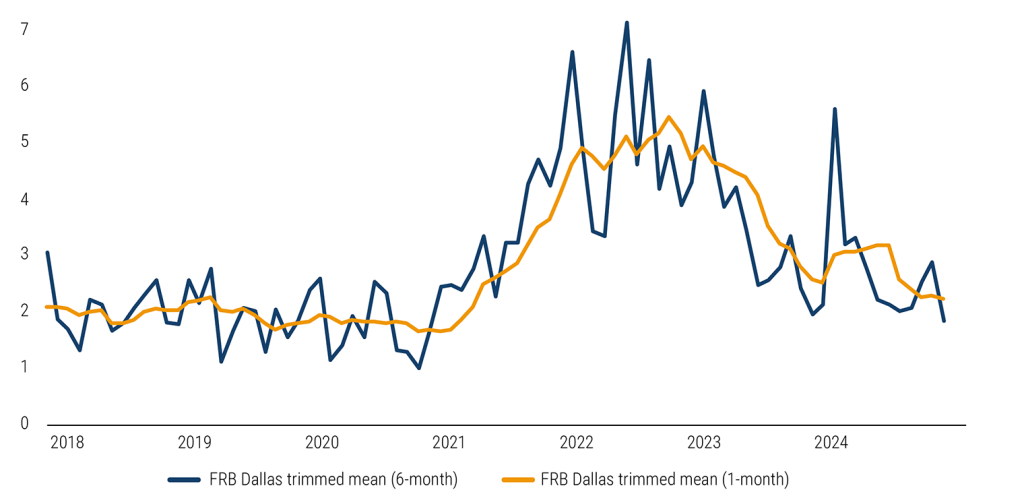

Another important measure is the trimmed mean PCE, which excludes the highest and lowest values of the personal consumption expenditures (PCE) to focus on the core inflation trend. Both the one-month and six-month annualised rates of change indicate that we are moving in the right direction, similar to to pre-Covid levels (Figure 2).

Figure 2: Heading lower - Core inflation metrics continue to trend down

Trimmed mean personal consumption expenditures (%)

Source: Federal Reserve Bank of Dallas, as of 15 January 2025. The trimmed mean PCE inflation rate is an alternative measure of core inflation in the price index for personal consumption expenditures (PCE). It is calculated by staff at the Dallas Fed, using data from the Bureau of Economic Analysis (BEA).

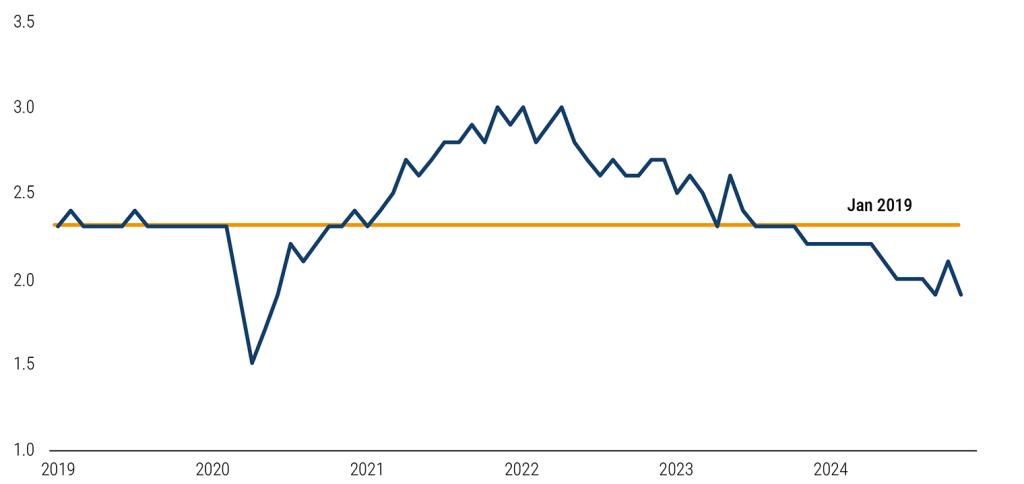

Importantly, data continues to show a slow but steady softening in the labour market. The quits rate, which indicates workers’ willingness to leave their jobs for better opportunities, is below 2019 levels (Figure 3), suggesting a less dynamic labour market. Additionally, the monthly average change in nonfarm payrolls has been declining each year, with no immediate signs of reversal.

Figure 3: Quits rate also heading down - Labour market continues to soften

Quits rate (%)

Source: US Bureau of Labor Statistics, Quits: Total Nonfarm [JTSQUR], retrieved from FRED, Federal Reserve Bank of St. Louis.

Patience is the name of game

Given these observations, we believe inflation in the US will continue to move lower as the labour market continues to weaken. This, in turn, could prompt the Fed to cut rates more than the current forecast of two cuts in 2025. However, the impact of President Trump’s economic agenda remains a wildcard, with its precise effects on inflation uncertain.

We believe the Fed’s approach to monetary policy in 2025 will be dictated by two risks. The first is the tail risk of the economy overheating, fuelled by a negative supply shock from tariffs and the immigration policy, plus a positive demand shock from tax cuts and higher fiscal spending. This combination could impede further progress on reducing inflation and bring the Fed’s easing cycle to an abrupt end.

The second risk is that labour market trends continue, with wages remaining a weak passthrough into inflation. With inflation under control, the Fed can focus on adjusting policy to better support the slow but steady decline in the labour market. It is the former scenario that has dominated market sentiment in the early days of 2025, with intermediate and longer maturity Treasury yields rising uncomfortably close to cycle highs.

Notably, while we have a view on how inflation and the labour market will evolve, we think fixed income returns will prove to be more dependent on starting valuations than a specific macroeconomic outcome. For example, fixed income yields are generous today because the risk-free rate has risen, not because credit spreads are wide. Higher risk-free rates – and real yields specifically – suggest that investors are being more appropriately compensated for the risks of stronger growth, greater inflation uncertainty, and/or rising fiscal deficits. In contrast, credit spreads remain near their tightest levels since the 2008 global financial crisis. This creates asymmetric risk that spreads could move wider, which would erode returns relative to duration-neutral Treasuries. As such, we see better value in duration risk – not because we are betting on the Fed, but because we are receiving better compensation relative to the risk.

So, the name of the game for 2025 is patience. We do not know exactly when the turning point will come, but we are positioned to make the most of elevated yields while mitigating potential downside from widening spreads by focusing on higher quality opportunities in shorter maturities where prices historically demonstrate less volatility.