Economic paths diverged in Q1 as Covid-19 infections rose in many parts of the world once more, leading to further restrictions. At the same time, the US and the UK accelerated their vaccination programmes, allowing both countries to set a path to reopening well ahead of the summer. Europe is now seeing an improved rollout as well, while Japan continues to lag. The situation remains dire in many emerging economies, however, where the lengthy battle to slow the spread of the virus continues to rage.

The US benefited from President Biden’s $1.9 trillion fiscal package, delivered promptly in a bid to fuel growth and employment after a loss of momentum in late 2020. While other developed countries have not seen anything like the same scale of fiscal support as the US, their economies have nevertheless adapted to the stop-start nature the pandemic has brought and have fared better than expected during recent bouts of restricted mobility.

The path to reopening depends heavily on the pace of vaccinations. Travel, entertainment and hospitality remain the hardest-hit sectors, but these are starting to see a brighter future where vaccine rollouts are boosting confidence. We expect pent-up demand for services to drive growth in the second half of the year, leading to bouts of inflationary pressure, which central banks will likely look through.

Having successfully backstopped financial markets with huge quantitative easing programmes, central banks will continue to grow balance sheets over the coming quarters, and these should stay elevated over the long term. Governments will need extended support to manage increased levels of debt, which will further weigh on the potential growth of economies, capping inflationary pressures.

The US: peak in growth momentum in sight

More than a year has passed since Covid-19 hit US shores, stopping the economy in its tracks. Rapid monetary and fiscal support arrested the slide, lifting financial markets and leaving households with additional liquidity even as unemployment rose. After a brief loss of momentum in the final quarter of 2020, fiscal largesse is setting a course for the economy to recapture pre-Covid dollar levels before the summer.

Biden’s first support package, totalling $1.9 trillion, was set in motion via reconciliation, after a swift rejection from the Republican Party. Further sizeable, longer-term programmes tackling infrastructure, the environment and inequality – among other issues – may be harder to pass. But for now, the accelerated vaccine rollout, easing restrictions for service providers, and bloated household savings will drive growth of 6% and above for this year, and reinvigorate the employment recovery over the coming months. This increase in activity will no doubt lead to bouts of inflationary pressure, which the central bank has already indicated it will look through.

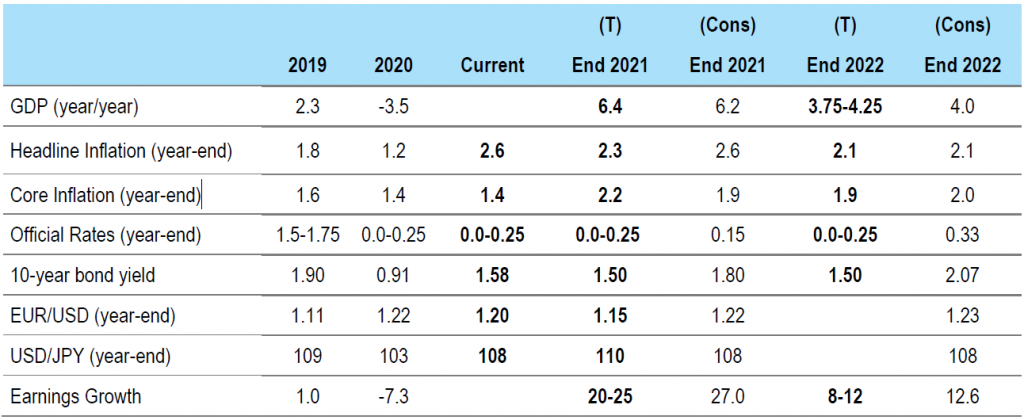

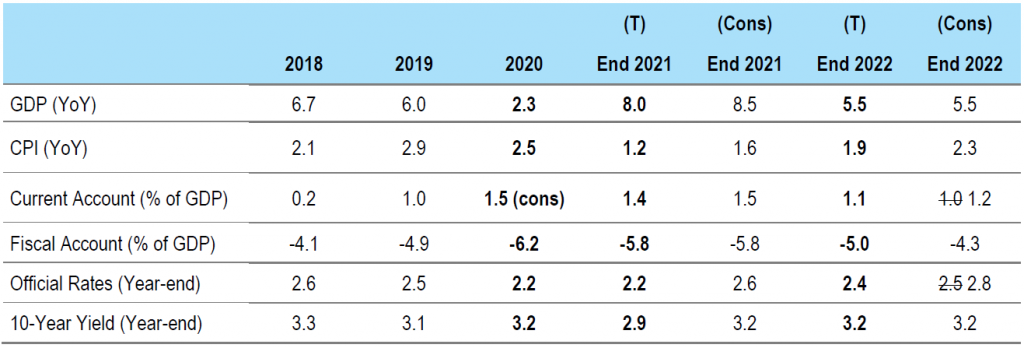

Figure 1: US forecasts

Source: Threadneedle Asset Management Limited/Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast * denotes interim change. Changes to Threadneedle forecasts: GDP 2021 6.4 from 5.0; Headline Inflation 2021 2.3 from 2.0; Core Inflation 2021 2.2 from 1.7; EUR/USD 2021 1.15 from 1.27; USD/JPY 2021 110 from 100.

City centres are witnessing the slowest recovery in mobility, as working from home remains a realistic and preferred option for some – a trend likely to be in place for some time. Increased remote working drove the desire for larger dwellings, resulting in a red-hot housing market in the suburbs through the winter. As more of the population get vaccinated and many would-be buyers are “priced out” of the market, we might expect turnover to settle into a more sustainable path.

Continued support for the economy remains crucial. The US Federal Reserve is acutely aware that the pandemic has disproportionately hit low-income, minority households. Chairman Jerome Powell has stated his intention to leave rates low for however long it takes to aid the repair.

Euro area: playing catch-up

After a stuttering start, the pace of mainland Europe’s vaccination rollout is now accelerating. And while activity levels have generally seemed more resilient to mobility restrictions than during periods of lockdown last year, Covid-19 continues to cast a shadow over the euro area’s economic performance. It remains to be seen what effect additional restrictions – introduced notably in France and Germany in mid-April – will have on Q2 GDP.

That said, indicators of economic sentiment remain on an upward trajectory, especially in manufacturing, where new orders appear to be driving a post-pandemic boom. So far, the “hard” data does not reflect increased optimism; it is possible that lags are in play, or that surveys display excessive optimism, as they did during the 2017 expansion.

The health of the labour market may be the best guide to the likely strength of domestic demand, although data here continues to be distorted by large numbers of people engaged on short-time work programmes. The degree of slack in eurozone labour markets may not be obvious for some time.

Until then, optimism around a vigorous (and inflationary) recovery in consumption rests on a robust reversal in the accumulation of savings by households over the past year or so. But analysis by the Banque de France and others suggests that by far the largest share of foregone consumption during the pandemic has occurred within services, where there are obvious limits to how much can be recouped. Additionally, as elsewhere savings have tended to accumulate at the higher end of both the income and demographic distributions, where propensity to consume is lower, all else being equal.

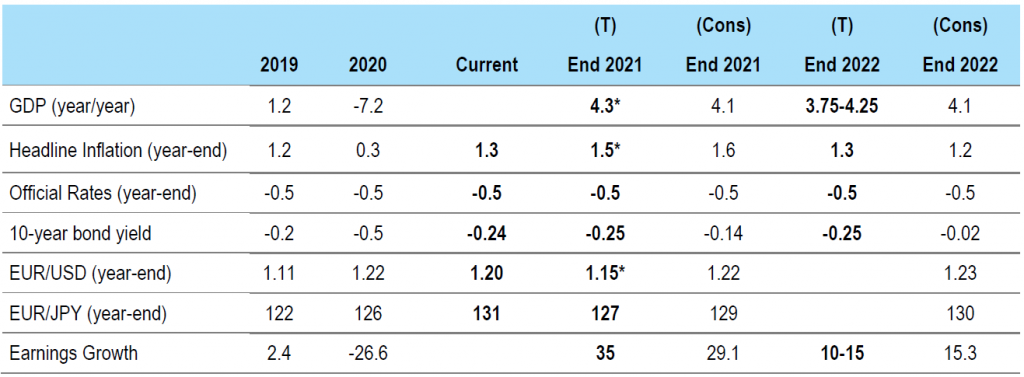

Figure 2: Euro area forecasts

Source: Threadneedle Asset Management Limited/Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast * denotes interim change. Changes to Threadneedle forecasts: GDP 2021 4.3 from 4.0; Headline Inflation 2021 1.5 from 1.0; Official Rates 2021 -0.5 from -0.6; EUR/USD 2021 1.15 from 1.27.

The European fiscal response appears small in comparison with the combined US stimulus. In contrast with their North American counterparts, household disposable incomes have stagnated since the end of 2019 in the Euro area, where fiscal support has been largely delivered via job retention programmes. We believe this will likely deliver a less impressive recovery.

But medium-term hopes for a higher path of GDP growth are best pinned on an eventual rotation away from pro-cyclicality in member-state budget policy as embodied in the eurozone’s fiscal framework. It seems likely that the EU’s Stability and Growth Pact deficit and debt ratio requirements will be suspended until at least 2023. Negotiations around more permanent changes are likely to resume later this year.

UK: bouncing back, for now

The success of the vaccination programme thus far has enabled the UK to take the first steps out of lockdown. The signs of pent-up demand from the consumer have been evident in the data that has been released: card spend has returned to pre-Covid levels and retail footfall has picked up sharply. Positive signs are evident in the labour market as well, where job vacancies have risen back to pre-pandemic levels, albeit with a significant dispersion of performance across industries.

Expectations that furloughed positions will result in permanent job losses at the end of the programme have trended lower but remain elevated, and suggest that around 10% of those on the scheme will become unemployed in September.

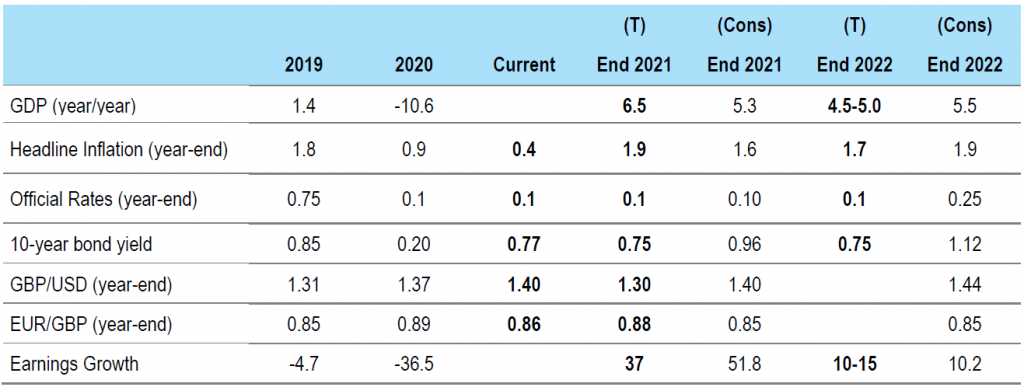

Figure 3: UK forecasts

Source: Threadneedle Asset Management Limited/Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast. Changes to Threadneedle forecasts: GDP 2021 6.5 from 4.0; GDP 2022 4.5-5.0 from 5.5-6.0; Headline Inflation 2021 1.9 from 1.5; Official Rates 2021 0.1 from -0.1; 10-Year Bond Yield 2021 0.75 from 0.25 GBP/USD 2021 1.30 from 1.40; EUR/GBP 2021 0.88 from 0.91.

The sharp rebound in activity was expected and is a testament to the insulation of the aggregate consumer balance sheet via government support schemes. However, we would add that disposable incomes have not grown over the pandemic, unlike, for example, in the US. This is likely to have a negative impact for the UK’s future path of consumption. Savings remain elevated due to the inability to consume services, and we expect a decent portion of these pots to be run down over the course of the year as the consumer enjoys re-found freedoms.

Recent surveys have suggested more of this savings glut will be spent than we had previously expected, although the distribution of these savings is still heavily skewed towards those with a lower marginal propensity to consume.

Japan: another Covid wave delays a sustained consumer rebound

We have lowered our 2021 GDP forecast for Japan from 4% to 3.5% but remain above consensus due to increased support from external demand more than offsetting a negative Q1. Indeed, leading indicators such as machine tool orders continue to trend higher and Japanese consumers are in a strong financial position to lead a sustained domestic demand recovery once vaccines are rolled out. The key driver behind our revised outlook is the emergence of a fourth wave of Covid, and with it a third state of emergency, which will delay the consumer rebound.

While Japan’s management of the virus has been relatively successful, its vaccination rollout has been noticeably slower than other regions, due to its lengthy testing process. However, the pace of vaccinations is expected to pick up through Q2. This should drive a sustained consumer rebound through the second half of the year, aided by policy support that has prevented disposable income taking the usual hit during a recession.

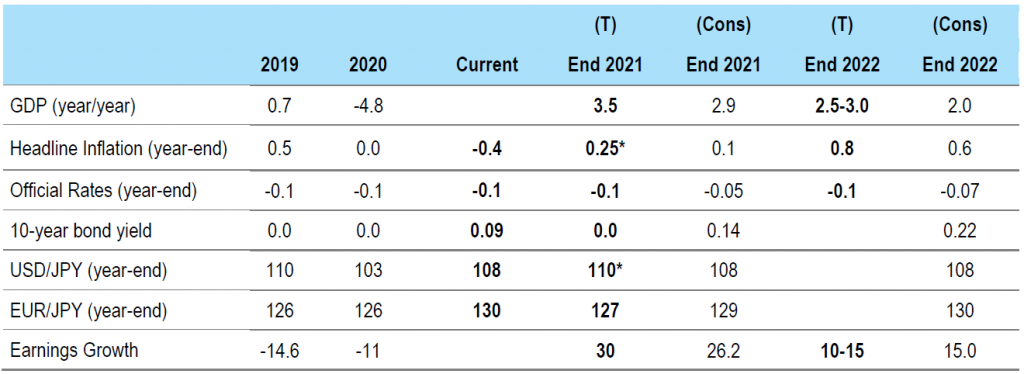

Figure 4: Japan forecasts

Source: Threadneedle Asset Management Limited/Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast. Changes to Threadneedle forecasts: GDP 2021 3.5 from 4.0; Headline Inflation 2021 0.25 from 0.5; USD/JPY 2021 110 from 100.

Another area of domestic demand that looks set for a strong year is corporate capex; realised numbers tend to be higher than anticipated at the start of the year, and this year’s starting point was the highest in five years. On the external front, trade data remains encouraging and points to another strong net-export contribution to GDP in Q1.

Japan’s labour market remains tight with the job:applicant ratio increasing again, having remained above one throughout this crisis. However, as previously flagged, wages rather than the employment level that tend to move over the economic cycle in Japan. These usually lag earnings, which have picked up impressively, and suggest the labour market could start to potentially act as a tailwind rather than a headwind from here.

Overall, we expect a fall in domestic activity to lead the economy into contraction in Q1, but also anticipate that the ongoing support from the external component of the economy will make this less severe than in 2020. Once vaccinations pick up, we expect a strong and sustained domestic activity rebound to coincide with the ongoing strength in the external component of the economy.

China: policy focus shifts

While the world is still largely trying to control the virus and stimulate growth, China comfortably recorded positive GDP growth of 2.3% year-on-year in 2020, and is expected to grow at around 8%-8.5% in 2021. This earlier rebound is giving policymakers the opportunity to restart fine-tuning the economy with the aim of ensuring financial stability, improving people’s wellbeing and enhancing national security. This will see a reallocation of credit away from highly leveraged sectors to “priority” sectors that will inadvertently lead to a moderation in credit growth as well.

China’s post-pandemic V-shaped rebound was largely led by real estate and pandemic-related exports, with the laggards – retail sales and manufacturing investments –expected to drive growth in 2021. While Q1 growth fell significantly to 0.6% from 3.2% in Q4 2020, given the wave of new Covid cases in the run-up to the Lunar New Year, March numbers are encouraging as consumption and industrial capex expansion seem to be overtaking property investments and exports as the main drivers for growth. Given geopolitical tensions with the US, China’s 14th Five-Year Plan emphasises reducing vulnerabilities to “chokepoint technologies”, with banks being encouraged to focus lending towards smaller businesses, manufacturing, green and high-tech sectors this year.

Figure 5: China forecasts

Source: Threadneedle Asset Management Limited/Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast.

Concurrently, the government is using a broad range of regulatory changes to manage financial stability, increase corporate governance and reshape the country’s drivers of growth. Credit growth will undoubtedly slow from more than 13% year-on-year to around 11.5%, as we see stricter regulations on housing market and property developers, fintech capitalisation, further defaults in weaker companies, local government financing vehicles and the consolidation of state-owned enterprises. There are always uncertainties in a transition and, as such, officials are expected to be cautious with monetary and fiscal policies. There is likely to be extreme caution in the next quarter, given the need for policy stability prior to the Chinese Communist Party’s July centenary celebrations. The People’s Bank of China is expected to keep official policy rates on hold and liquidity balanced, while the government has certainly buffered the fiscal space with a wider-than-expected 3.2% fiscal deficit target, a RMB3.65 trillion ($570 billion) quota for net-local government bond issuance and higher-than-usual fiscal deposits.

Ultimately, the Chinese government wants to avoid financial asset and debt bubbles, reduce its vulnerabilities to external policies, and increase domestic demand. So long as the target-surveyed urban unemployment rate remains at around 5.5%, with 11 million jobs created, these structural reforms will continue.

Emerging markets: asynchronous economic recovery

Emerging markets (EMs) started the year full of optimism, fuelled by the start of the vaccination process and the expectation of a synchronised upturn in global economic activity. These factors, together with ample liquidity, were supposed to underpin the recovery story in EMs. However, disappointment soon set in, especially in terms of growth, as slow vaccine rollouts and the continued resurgence of Covid-19 cases in EMs have caused the growth trajectory to lag relative to developed markets.

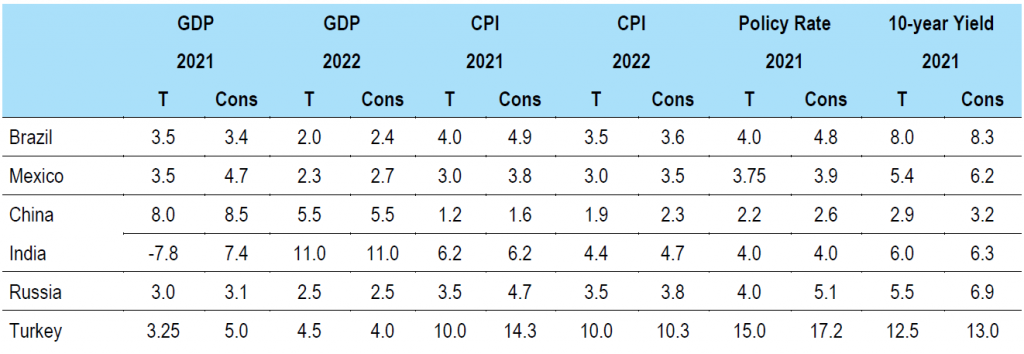

Figure 6: EM forecasts

Source: Threadneedle Asset Management Limited, Bloomberg, April 2021. Notes: (T) = TAML forecast, (Cons) = consensus forecast.

The stronger recoveries in the US and China have, however, supported global demand and pushed commodity prices higher, providing a positive tailwind to EM economies in general. At the same time, global financial conditions remain highly accommodative, with both local and external financing readily accessible in all but a few highly stressed sovereigns. The recent developments on the new $650 billion IMF Special Drawing Rights allocation, and the extension of the Debt Service Suspension Initiative until the end of 2021, also create a positive tailwind for those weaker high-yield sovereigns that are facing large external financing requirements while having thin external liquidity.

Looking ahead, the outlook appears fairly challenging. The uncertainty created by the pandemic remains high and continues to pose a downside risk to growth. At the same time, policy support will arguably be more constrained after 2020’s substantial fiscal and monetary support, which brought policy rates to historic lows and pushed government leverage up significantly. With non-core inflation starting to rise (though this should be transitory), policymakers with weaker credibility may be forced to start tightening in order to maintain a decent real-rates buffer, anchor inflation expectations and prevent FX depreciation and sharp capital outflows. The balancing act in the months ahead will be delicate. This also means that stronger bifurcation is expected to play out within EMs, with countries with weaker fundamentals going into the crisis likely to be the ones that come under further pressure if the pandemic is prolonged.