There is an increasing realisation that carbon capture and storage (CCS) technologies play a crucial role in meeting net zero. Even though a number of CCS technologies have existed for some time, it hasn’t been until the past year or so that there has been growing interest and appetite.

Recognition of its importance will translate into growing policy support and investment, which in turn will accelerate the development of the CCS market over the next decade. We believe this will provide investors with investment opportunities across the value chain.

What is CCS and why is it a growth area?

Intrinsic to the development of this market is the goal to achieve net zero emissions. Countries accounting for more than 80% of global emissions have made net zero commitments, as have around 700 of the world’s largest public companies1. These actors are increasingly embracing CCS technologies as crucial elements to deliver their net zero plans and hit their targets.

In addition to CCS, there is an increasing scientific consensus – especially after the latest IPCC report2 in April – that the use of wider carbon removal technologies is “unavoidable” to achieve net zero. The leading technology in this space is Direct Air Capture (DAC). This uses chemical reactions to pull CO2 out of the air before it is either injected deep underground for permanent storage or used elsewhere.

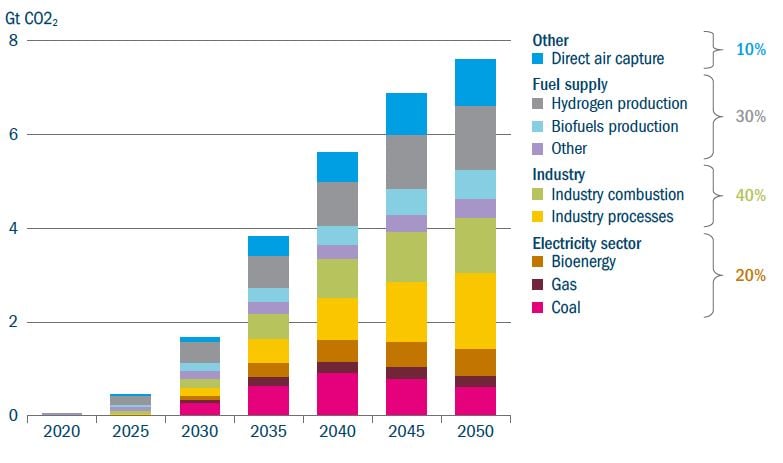

In line with this, the Science Based Target Initiative (SBTi), a partnership between the Carbon Disclosure Project, the United Nations Global Compact, the World Resources Institute and the World Wide Fund for Nature, includes in its net zero standard that “any remaining emissions (up to 10% not covered by the long-term target) must be neutralised with permanent carbon removals”.3 Therefore, the increasing view is that carbon removals have a key role in climate change mitigation strategies – in addition to, not instead of, rapid decarbonisation efforts. As per the International Energy Agency net zero scenario, most of the CO2 captured will have been produced by heavy industries and fossil fuels, followed by the wider power sector and by DAC (Figure 1).

Figure 1: CO2 captured in net-zero scenario

What drives CCS costs?

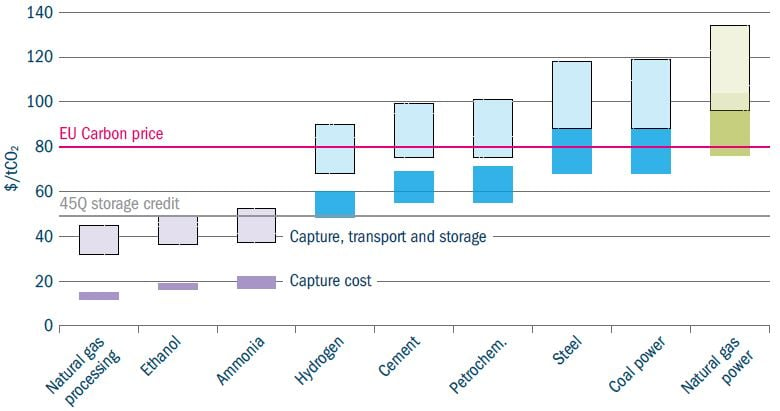

Figure 2: CCS costs per tonne of CO2 across different applications

Why now for CCS?

Policy support: strengthened policies, such as the US Infrastructure Deal or the EU and UK Green deals include significant government funding to support R&D and expand demonstration projects.

Economics: higher carbon prices and tax incentives are improving the economics of these projects. For example, EU prices doubled over the past year and in the US 45Q tax credits are providing important subsidies for CCS investments.

Market dynamics: the rise of industrial hubs that share not only innovation but also the costs of transport and storage are becoming a key driver of economies of scale.

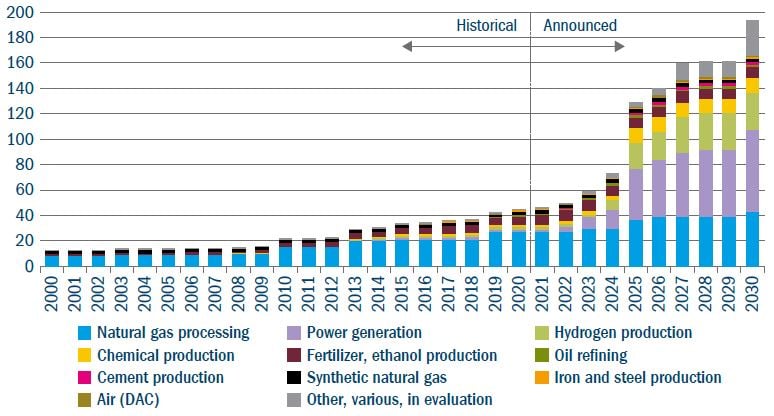

In terms of the potential size of this market, the current amount of CO2 captured represents less than 1% of global emissions. To meet IEA net zero targets, whereby CCS would contribute reductions of around 15%, the average capture rate would need to increase 10x by 2030. The project capacity announced to date will require investment between $140 billion and $1.1 trillion – significantly more than the $3 billion spent in 2020. However, to meet the IEA’s targets will require much more, with estimates ranging from $760 billion5, $1.6 trillion6 and $3 trillion7.

The development of this market, however, faces challenges. Although there has been progress, global climate policies and carbon pricing is not yet supportive of DACs economics to such a level to meet the IEA net zero roadmap, so more policy support is required. In addition, a simpler and shorter permitting process is needed as the regulatory approval can be lengthy, as well as limited liability protection to finance projects.

Figure 3: Global capacity installed by point source, historical and announced

How can investors play this theme?

Source: BloombergNEF, CCS Market Outlook, 2021

Climate transition engagement: CCS technologies

Company: OXY

Sector and country: Energy, US

Why we engaged

As part of our thematic engagement on the back of our research into carbon capture and storage (CCS), we engaged with OXY to better understand the technologies and associated economics that will drive its net zero strategy.

How we engaged

The engagement was led by Fixed Income and Equity analysts, in addition to an RI analyst, and took the form of a video conference call with OXY’s Deputy Counsel, an executive from the Environmental and Sustainability Group, and a representative from investor relations.

What we learnt

OXY considers the achievement of net zero a strategic priority. The economics of its plan will require further and ongoing consideration, but could prove to be attractive under reasonable carbon price/incentive scenarios. Furthermore, OXY appears uniquely positioned in terms of its ability to employ direct air capture (DAC) and carbon capture, utilisation and storage (CCUS) strategies, which will form a key component in helping to decarbonise several hard-to-abate sectors.

Outcome

The meeting gave us a better insight and understanding of the economics of DAC projects and the role of this technology for OXY’s net zero plans. The meeting also enabled us to emphasise the increasing importance of environmental, social and governance (ESG) disclosure, encourage the adoption of more granular targets and highlight the growing scrutiny that carbon-intensive sectors will face going forward.