Scene 1

Scene 2

A pandemic emerges stage left and it’s curtain down on economic activity. Policy actors now throw every tool they have to counter the economic hole left in its place.

Scene 3

A vaccination emerges from behind a cloud of smoke and life can begin to return to normal. But there is huge pent-up demand after so many months of restraint. Meanwhile, the policy actors are not convinced that the recovery – especially in terms of jobs – is cemented yet. The stage is set for a bump up in inflation starting in the summer.

Scene 4

But what happens after the summer? Inflation or no inflation – that is the question? (From Hamlet, yes, but forgive us the appropriation!)

The question is probably too simplistic. We are not talking here about inflation reaching the runaway levels of the 1970s, but more whether we emerge, post-pandemic, in a world where inflation sustains above levels targeted by central banks, the most notable of which is the 2% targeted by the US Federal Reserve. As a result, would a return to inflation be enough to shift us away from the low growth, low inflation, low rates world in which we have been investing since the GFC?

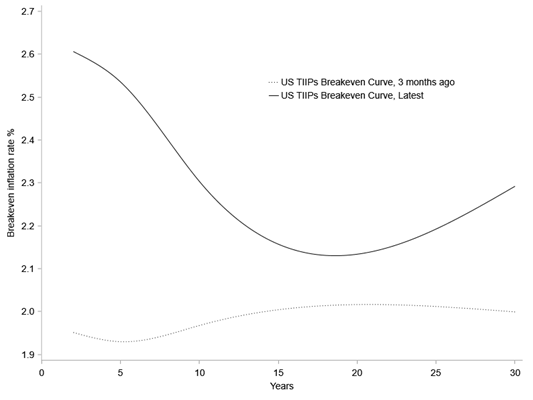

Fixed income markets believe we are already there, in the US at least, where breakeven curves are already pricing inflation to stay above the Fed’s 2% target for the next 30 years (see Figure 1 below).

Figure 1: US TIPS Breakeven Curve

Source: Macrobond, 24 March 2021

Our view is that it is difficult to see any spike in inflation being more than transitory in nature because, ultimately, the structural challenges that were there before Covid remain. These include: debt (and now more of it); ageing demographics; and technology. All have generated disinflationary trends, even in the face of peak globalisation.

However, we are not complacent. The appetite of governments to use fiscal policy to support economic growth has grown – even more so now under President Biden’s administration – and this has the potential to improve the growth side of the equation. Probably the more appropriate question we need to be asking ourselves is whether we are heading into a period of more inflationary growth? In such an environment, growth becomes less scarce and bond yields are higher – put simply, there are more options for investors.

The path to a more inflationary growth environment is unclear but it certainly appears more possible than it was before the pandemic. Hence, since the vaccine news in November we have added selectively to stocks in core global equities portfolios that give us more exposure to a cyclical upswing in the economy. Companies we have bought include Yaskawa, a Japanese manufacturer of industrial robots, and General Motors, the US auto manufacturer that is fast transitioning to electric vehicles. Both names also look well-positioned in a post-Covid world, landing on the right side of some of the longer lasting impacts the virus will have on our economy, which we have talked about previously here on our blog.

Nevertheless, our base case is still that inflation and growth will be hard to come by over the longer term and the current market tussle between growth and value is beginning to give us opportunities to pick up stocks we have been watching for a while but where we have been held back by valuations, such as Paypal, which we believe will be a long-term winner in the payments space.

A new play? Rewriting the inflation script

We are at the beginning of one of the biggest changes in our economic history – the electrification revolution – as countries aim for carbon neutrality. The net cost of renewables, once built, is close to zero – it is a beautifully free, unlimited and clean resource, unlike fossil fuels. And because of all these attributes it may well have a net inflation impact of zero. The potential importance of this cannot be understated – the oil price crises of the past could be consigned to history and the inflation equation permanently changed.

Transportation, food, medical and housing account for more than 70% of US inflation¹, and each of these categories is experiencing structural change, be it electrification, automation, or the migration to suburbs. What is clear is that the drivers of inflation in the future may well be different from those in the past.