- We see three themes dominating 2021: the development of a Covid-19 vaccine; the political make-up of the US following the November election; and Brexit.

- Our research intensity powers our understanding of these themes, trends and events, and positions us strongly to navigate through financial markets for our clients.

- Following unprecedented levels of stimulus the level of debt is going to be even greater than it was after 2009 and we will emerge into a world of low inflation, low growth and low interest rates – not a backdrop where economic sensitivity is likely to outperform over the longer term.

- Instead, this environment will favour the type of investments that Columbia Threadneedle Investments makes – longduration assets and durable growth companies with: sustainable returns driven by a sizeable moat, a high Porter’s Five Forces score, strong environmental, social and governance credentials and sustainable competitive advantage. We want risk within portfolios, but we want controlled risk.

- The UK equity market is clearly cheaper than others and may benefit if we see the recovery we expect to see over the next 9-12 months; Europe and Japan are in a similar position. Longer term, we can see further potential in the US and Asia/emerging markets.

- We like an element of risk within credit, but we believe investment grade is ultimately a better home for it than high yield, where we see a greater risk from higher financial leverage, particularly when coupled with high operational leverage.

- As active managers we have performed strongly throughout the pandemic crisis, using our knowledge, expertise, collaborative skills and research capabilities to remain calm. This consistent approach will continue to be followed in 2021, helping us identify trends and investment opportunities, whatever next year may bring.

Introduction

At the beginning of the year we were threatened with excitement, be that trade wars or ongoing political upheaval in the Europe and

the US. None of us were prepared for a global pandemic. In March, markets descended into chaos as Covid-19 swept around the

world, with equity markets down by more than 30% and credit spreads widening hugely. From there we have witnessed an initial

rally driven by central bank stimulus, followed by ongoing market volatility and more recently a “sugar rush” of market excitement

following the announcement of potentially effective vaccines.

All of this played out against a backdrop of three areas that will continue to be of huge importance in 2021: the development of

further effective Covid-19 vaccines; the political make-up of the US following the November election and the forthcoming runoff

elections that will decide which party controls the Senate; and Brexit.

As asset managers we are only able to navigate our way through the potential scenarios and impacts from the above factors

because of our research capabilities, what we call our Research Intensity. These power our understanding of themes, trends

and events, lead us to attractive investment opportunities and allow us to maintain an element of calm in the midst of “panic”.

Covid-19: the search for a mass vaccine nears its end

“The critical thing for us is to ensure we remain invested in the companies

that are going to make it through and ultimately benefit from the

economy reopening.”

US political landscape: healthy for equities and credit?

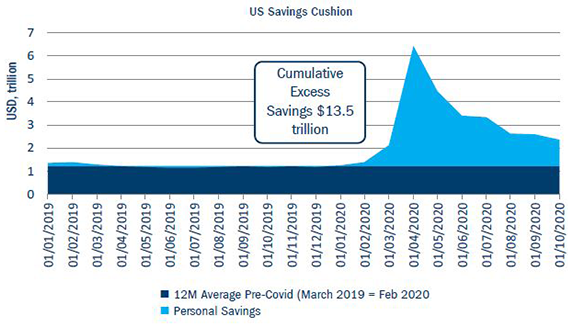

A new round of stimulus will no doubt be the first order of business for the Biden presidency, likely containing a combination of small business support and another round of direct payments to households. We expect changes in health care, though the future in this sector is difficult to predict, and we believe the climate will be addressed in the early months: extending current schemes (and creating new ones) that incentivise clean energy is likely.

Brexit

“The UK has endured an extremely challenging period… any positive news – be that vaccine-related, Brexit or otherwise – could open the door for a stronger performance from UK equities in 2021.”

Markets, themes and opportunities: quality set to endure

“Volatility will likely continue to be elevated in 2021, but it would be a mistake to make knee-jerk reactions to sudden strong moves in markets. Again, as investors we must maintain our strategic positions and focus on the longer term.”

Volatility will likely continue to be elevated in 2021, but it would be a

mistake to make knee-jerk reactions to sudden strong moves in markets.

Again, as investors we must maintain our strategic positions and focus on

the longer term.

Equities

In Japan we would look at Shinzo Abe’s replacement as prime minister,

Yoshihide Suga, as being very much the continuity candidate. He has

made positive noises about continuing on the path that has seen the

country embrace corporate governance and regulatory reform, digital

transformation and a more attractive environment for foreign tourists and

workers. Japan has significant exposure to industry within its market,

particularly to Chinese investment, so we see an improved outlook for

Japanese equities going into the recovery, even if Japan’s demographics

do continue to create a real headwind.

Credit

Investment grade markets benefited directly from fiscal stimulus such

as corporate bond-buying programmes and furlough schemes. We do

see some downgrade risk when those props are removed, but there is

a greater risk in the high yield area where investors must tread carefully

due to higher financial leverage. Not all those companies are going to

make it through – indeed, if high financial leverage is linked to operational

leverage, which it often is, one should tread ever so carefully. So while

we like an element of risk within credit, we believe investment grade is

ultimately a better home for it than high yield.

Active managers powered by research

“As active managers we have performed strongly throughout the pandemic crisis, using our knowledge, expertise, collaborative skills and research capabilities to remain calm.”