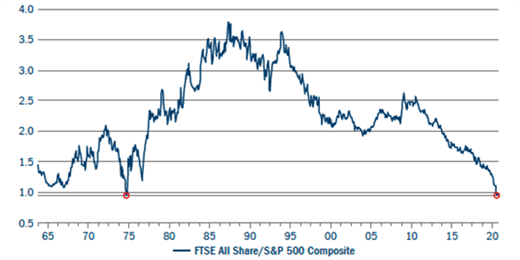

- The UK remains very much out of favour, with only Russia and Brazil performing worse year-to-date, and asset allocators still reluctant to look at UK equities, which are even cheaper than they were a year ago. International companies listed in the UK, pound-for-pound are on double discounts versus if they were quoted in Europe or the US, and an average of a 40% discount to the World MSCI.

- That the UK remains so unloved typifies the high levels of consensus thinking in markets. We continue to firmly believe in the UK, but trends often go on for longer than predicted. This creates the opportunity we see today, as it amplifies the impact when the switch in momentum finally occurs.

- Brexit has finally been determined and the late, thin deal provides some certainty, as would a reasonable recovery in 2021. Given this, a lot of the short positions against UK equities are likely to be closed. Although Brexit will still result in some short-term frictional trade costs, this deal is a good outcome, removing a large part of the uncertainty that has weighed on UK equities in recent years.

- Dividends have a critical role in pensions, savings and the income of the British public. The unprecedented nature of the pandemic, and the consequential need for companies to restore their liquidity, led to a contraction in dividend payments in April and May which was one of the quickest, sharpest and broadest ever encountered. This is a process which comes at close of every cycle, but Covid-19 meant it was condensed into just three weeks. However since then, as conditions have stabilised, the tide has turned and 60 companies have already reinstated dividends. More will follow.

- Looking ahead we expect more prudent policies and better cover, and even in the worst-case scenario the UK market should still offer a healthy yield premium to bonds by next year. For now, however, balance sheets and liquidity are paramount.

Bipolar marketplace

We continue to firmly believe in the UK, but trends often go on for longer than predicted. This creates the opportunity we see today, as it amplifies the impact when the switch in momentum finally occurs

Consider how quickly the UK equity market rotated after Pfizer and BioNTech announced their successful Covid-19 vaccine data in mid-November. Many months of outperformance by growth stocks was erased in a single day, revealing that many investors have similar positions. The proliferation of quantitative investors, ETFs and factor-based investing has made the market unbalanced and typifies the high levels of consensus thinking.

We continue to firmly believe in the UK, but trends often go on for longer than predicted. This creates the opportunity we see today, as it amplifies the impact when the switch in momentum finally occurs.

Beware the closing window

Dividends are coming back

The best opportunities for a decade

As the UK’s double discount starts to narrow, following the greater clarity that Brexit should bring and as vaccines progress, 2021 and into 2022 could be exciting for the UK equity market