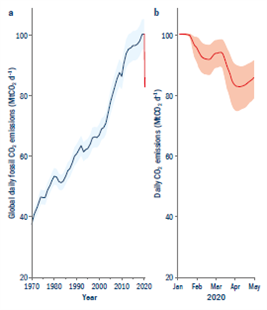

During the peak of the lockdown in London, it felt more like we were living in the countryside than one of the biggest cities in the world. The sky was strikingly blue, while the sound of birds chirping was no longer drowned out by the noise of cars and overhead aeroplanes. London was not alone. The global lockdown resulted in an unprecedented drop in global carbon emissions which fell 6% in the first quarter of the year and were down 17% in April alone!1

Unfortunately, this clean air was temporary. The first thing I noticed when lockdown eased was how poisonous traffic fumes smelt. How much damage does this polluted air cause to our lungs and those of our children? If governments could react so swiftly to a deadly respiratory virus, why can’t they react as urgently when dealing with air pollution and climate change? It turns out that I wasn’t alone in this thinking. For many, this pandemic has highlighted just how fragile humans are and accentuated the sense of climate change urgency.

Source: Nature Climate Change, 19 May 2020.

With major economies launching large fiscal stimulus programmes, governments have been given a once in a lifetime opportunity to recover and grow in a greener more sustainable way. Unfortunately, the world’s two superpowers and largest polluters, China and the United States, have focused instead on short-term economic recovery, with their programmes supporting polluting industries such as oil, gas and coal.

But Europe and many other countries including the United Kingdom, South Korea and Japan are all seeking a different path to economic recovery, one which also focuses on tackling climate change. The UK government plans to invest nearly £1.3 billion in “green” building projects2 and provide £2 billion in energy efficiency grants to support jobs and the economy.3 They have also allocated nearly £350 million to help cut emissions from heavy industry, construction and transportation.4

At the end of 2019 the EU presented its European Green Deal which set an ambitious roadmap towards a climate-neutral, circular economy. Instead of de-emphasising these long-term climate policies in favour of short-term economic intervention, the EU has instead placed this Green Deal at the centre of its recovery plans. The EU commission president, Ursula von der Leyen, stated “Sooner or later we will find a vaccine for the coronavirus. But there is no vaccine for climate change. Therefore [we] need a recovery plan designed for the future” .5

The EU Recovery Plan aims to kick-start an accelerated decarbonisation drive in Europe, bringing €1.8 trillion of investment in the next seven years. All of this will be aligned with climate neutrality targets whilst 30% of the total funding, c.€550 billion, will be spent in climate-related projects.

Key beneficiaries of this spend will be sectors such as renewable energy, clean transportation, buildings renovation (targeting improved energy efficiency) and hydrogen, as these areas are helping to tackle carbon emissions. July saw the release of the EU’s “Hydrogen Strategy for a Climate Neutral Europe” which will likely accelerate the decline in costs for green hydrogen globally as well as helping Europe to become a leader in the field.

Transitioning to a more circular economy is also a key part of the plan with the EU introducing a new plastic tax next year, which will favour companies providing alternatives to plastics as well as recycling solutions. Of course, creating jobs is a critical part of any recovery package with the EU plan aiming to create at least a million green jobs with support for workers in polluting industries to enter these new roles.

EU Climate Chief, Frans Timmermans, argues that a green shift will help create many more jobs, supporting stronger and more sustainable economic growth. Alongside the recovery package, the EU is also proposing to strengthen its 2030 target for emissions reduction from 40% to 55% based on 1990 levels.6 This level of ambition, if approved, would imply bigger cuts in emissions in the next 10 years than we have seen in the last 30! A Democratic win under Joe Biden will see the United States follow Europe’s lead. Biden has pledged to “build back better” in the US with $2 trillion for Clean Energy and Infrastructure Spending over four years.7 Of course, we’ll have to wait until November to find out if a Green US economic recovery will become a reality.

We own several companies in the Global Sustainable Outcomes strategy which will benefit from these green recovery investments, including: Orsted (offshore wind); Samsung SDI (EV supply chain); Kingspan (building insulation) and Sika (energy efficient building materials); Trane Technologies (energy efficient heating and ventilation equipment) and Johnson Matthey (the hydrogen value chain).