Threadneedle Global Extended Alpha Fund

Delivering alpha from winners and losers in global equities

The Threadneedle Global Extended Alpha Fund adopts a strong, bottom up stock picking approach to identify companies with superior earnings growth. Through that same process, we discover companies that may be structurally challenged in the long term, or face short term price dislocations – allowing us to short these underperforming stocks. The short positions are used to further fund the stocks which we have the strongest convictions. This process allow us to enlarge the alpha engine, but introduce minimal tracking error to the fund.

Overview

Simple approach, powerful structure

Invests in businesses with high or rising returns, above average growth and competitive advantages; and the opposite in the short book.

Three ways to tackle disruptive innovation

We primarily seek businesses that are difficult to disrupt and disruptors that fit our criteria, whilst shorting businesses that are being disrupted.

Strong return profile

A long track record of outperformance in rising and falling markets, delivered with high levels of consistency.

Trusted investment team

Managed by two managers with significant expertise in long/short investing, supported by our well-resourced global equity team and our extensive global research network.

Past performance is not a guide to future performance.

Key facts

- Launch date:

9 July 2008 - Index:

MSCI AC World - Typical portfolio characteristics:

Number of long positions: 60-100

Number of short positions: 0-40

Gross exposure: 120-160%

Net exposure (long – short): 90-105%

Process

The extended alpha concept - how it works

Greater opportunity to generate alpha

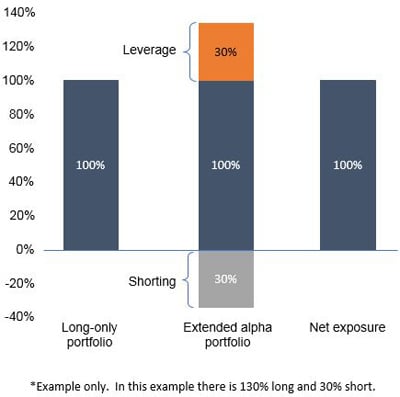

- Extended alpha funds combine a traditional long-only portfolio with a short portfolio

- In this example, the resulting portfolio is 130% long in favoured stocks and 30% short in stocks that are expected to underperform

- Short sales enable manager to increase long positions whilst maintaining a net exposure of 100% like traditional long only funds

Insights

UK Real Estate: Talking Points April 2025

Is the US heading for a self-inflicted recession?

Fixed income update: Bonds reclaim role as a volatility buffer

Fund Managers

Ashish Kochar is a portfolio manager for the Threadneedle Global Extended Alpha, American Extended Alpha, American Absolute Alpha and American Select funds. He also is responsible for consumer sector research.

Ashish joined the company in 2008 as a senior portfolio analyst within the US Equities team and subsequently joined the Global Equities team in 2010. He joined the company from a ‘Tiger Cub’ hedge fund and previously worked as an analyst for Merrill Lynch in New York.

Ashish holds an MBA from Mason School of Business, The College of William and Mary.

Neil Robson is Head of Global Equities at Columbia Threadneedle Investments. He took up this role in July 2017. He joined the company in 2011 as a portfolio manager within the Global Equities team. He is the deputy manager of the Threadneedle Global Select Fund and manages a number of global equity mandates for institutional clients. He is also the co-manager of the Threadneedle Global Extended Alpha Fund.

Before joining the company, Neil worked as a fund manager at companies including Martin Currie, Barings and Citibank. In addition, he was Head of Global Equity at Pioneer Investments from 2003 to 2009.

Neil has an Economics degree from the University of Bristol.

You may also like

About us

Millions of people around the world rely on Columbia Threadneedle Investments to manage their money. We look after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

Investment approach

Teamwork defines us and is fundamental to our investment process, which is structured to facilitate the generation, assessment and implementation of good, strong investment ideas for our portfolios.