Over ons

Verantwoord beleggen

Verantwoord beleggen is het onmisbare fundament van de toekomst. Overwegingen op het gebied van milieu, maatschappij en governance (ESG-overwegingen) krijgen juist daarom een belangrijke plaats in onze fundamentele benadering van beleggingsanalyse en stewardship.

Wilt u over de lange termijn een vermogen opbouwen? Dan zijn zulke overwegingen echt onmisbaar – aangevuld met intensief onderzoek, actief aandeelhouderschap en voortdurend bijleren.

Alle portefeuillebeheerders krijgen toegang tot ons onderzoek naar verantwoord beleggen. Teams kunnen ervoor kiezen om ESG-factoren zwaarder, lichter of helemaal niet mee te wegen in beleggingsbeslissingen.

Uitgebreide capaciteiten

Actief aandeelhouderschap

Productoplossingen

De markt kneden

45+

ESG-SPECIALISTEN

Onze deskundigen in verantwoord beleggen ondersteunen onze cliënten, beleggingsprofessionals en bredere bedrijfsbelangen met ESG-gericht onderzoek, engagement, stemmingen, gegevens, verslaglegging, productontwikkeling en screening voor gespecialiseerde ESG-portefeuilles.

250+

ONDERZOEKSANALISTEN

Portefeuillebeheerders, onderzoeksanalisten en ESG-analisten zijn de belangrijke poortwachters van het team voor verantwoord beleggen en zijn verantwoordelijk voor onderzoek naar concrete activaklassen en engagement. Dankzij al deze ondersteuning kunnen we in onze besluitvorming rekening houden met financieel wezenlijke ESG-kwesties.

40 jaar

ERVARING MET VERANTWOORD BELEGGEN

Al ruim vier decennia lang opereren wij, en onze voorlopers, als verantwoorde beleggers. Onze staat van dienst op het gebied van verantwoord beleggen reikt helemaal terug tot het eerste Europese fonds met screenings voor milieu en maatschappij, ruim 35 jaar geleden. We zetten via onze reo®-service in 2000 onze eerste engagement-initiatieven op tegen klimaatverandering en waren in 2006 een van de allereersten die de Principles for Responsible Investment van de Verenigde Naties onderschreven.

Wereldwijd excelleren in verantwoord beleggen

We hebben schatten aan ESG-expertise in huis, aangevoerd door ons gespecialiseerde team van deskundigen in verantwoord beleggen.

Een krachtige combinatie waarmee we de waardevolste inzichten uit ons beleggingsplatform kunnen toesnijden op de behoeften van onze cliënten.

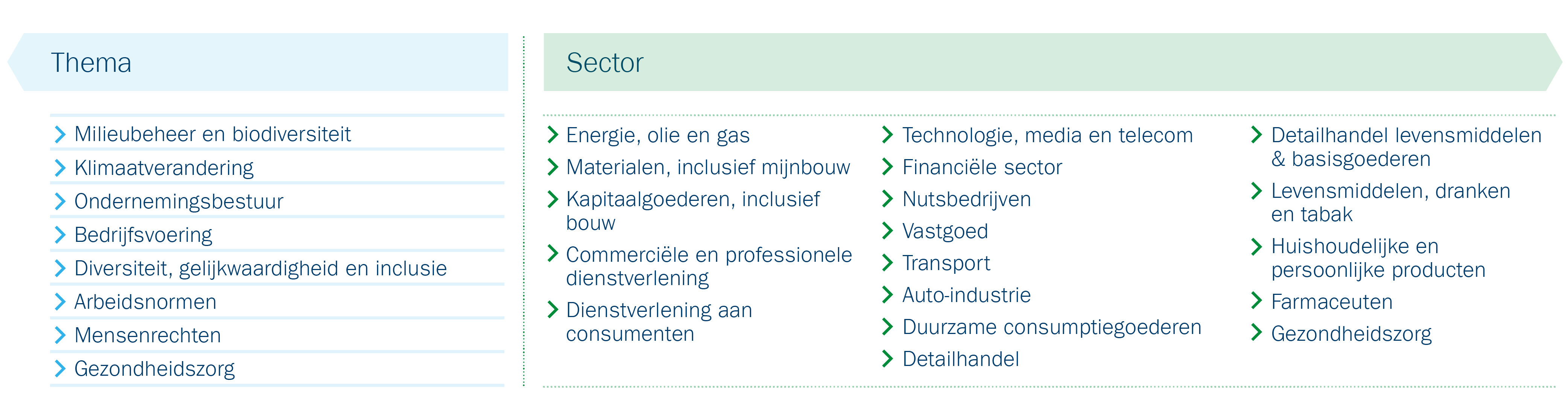

Sectorbrede expertise

Onze deskundigen in verantwoord beleggen hebben uitgebreide sector- en themaspecifieke expertise, waardoor we allerlei uiteenlopende beleggingskansen kunnen ontdekken en cultiveren.

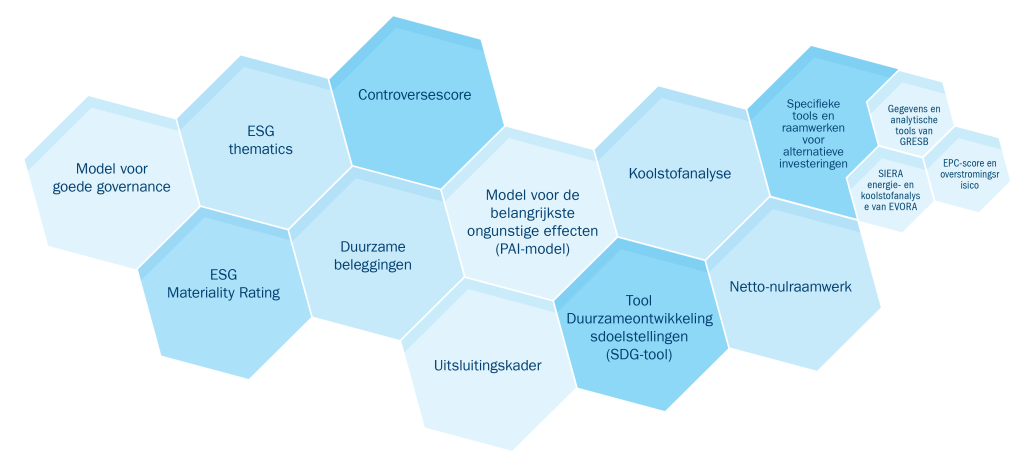

Onderzoekstoolbox en -raamwerken

We hebben een breed scala aan krachtige onderzoekstools en -raamwerken, waarmee we kunnen garanderen dat onze verantwoorde-beleggingscapaciteiten altijd geruisloos blijven draaien. Op die manier kunnen we ESG-overwegingen deugdelijk verankeren in beleggingsonderzoek, portefeuillesamenstelling en risicomonitoring.

In hoeverre er een beroep wordt gedaan op deze tools, is afhankelijk van het concrete cliëntmandaat en de strategische doelen.

Maximaal waarde creëren met proactief engagement en stemmen bij volmacht

Ons grote team actief aandeelhouderschap bezit een ware schat aan ervaring en expertise op het gebied van allerlei sectoren, branches en verantwoorde beleggingsthema’s. Door de handen ineen te slaan met onderzoeksanalisten en portefeuillebeheerders nemen ze belangrijke kwesties onder de loep en bevragen ze besluitvormers op verschillende niveaus over het beheer van ESG-factoren, -risico’s en -kansen.

Een onwrikbare vertrouwensband

Constructieve, vertrouwelijke gesprekken met besluitvormers, doorgaans één op één, vormen het zwaartepunt van ons engagement. Als langetermijninvesteerders beseffen we hoe belangrijk het is om relaties op vertrouwen te baseren.

We gaan ook met andere investeerders, niet-gouvernementele organisaties (NGO's) of brancheorganisaties in gesprek als we dat economisch gezien in het belang van onze cliënten achten.

Echt verschil maken door stemmen bij volmacht

We nemen namens onze cliënten deel aan stemmingen om op vooruitgang en verbeteringen op ESG-thema's aan te sturen en deze bedrijven ertoe aan te zetten er deugdelijke bestuurspraktijken en risicobeperkende strategieën op na te houden. Keer op keer blijkt dit een doeltreffende manier om voor het belang van onze cliënten op te komen en te garanderen dat bedrijven niet alleen onze zorgen en voorkeuren aanhoren, maar er ook naar handelen.

Aansturen op concrete resultaten

We stellen concrete engagement-doelen om onze waarde als investeerder te kwantificeren.

Onder de noemer 'actief aandeelhouderschap' scharen we een breed spectrum van ESG-risico's en -kansen voor bedrijven uit allerlei sectoren en regio's.

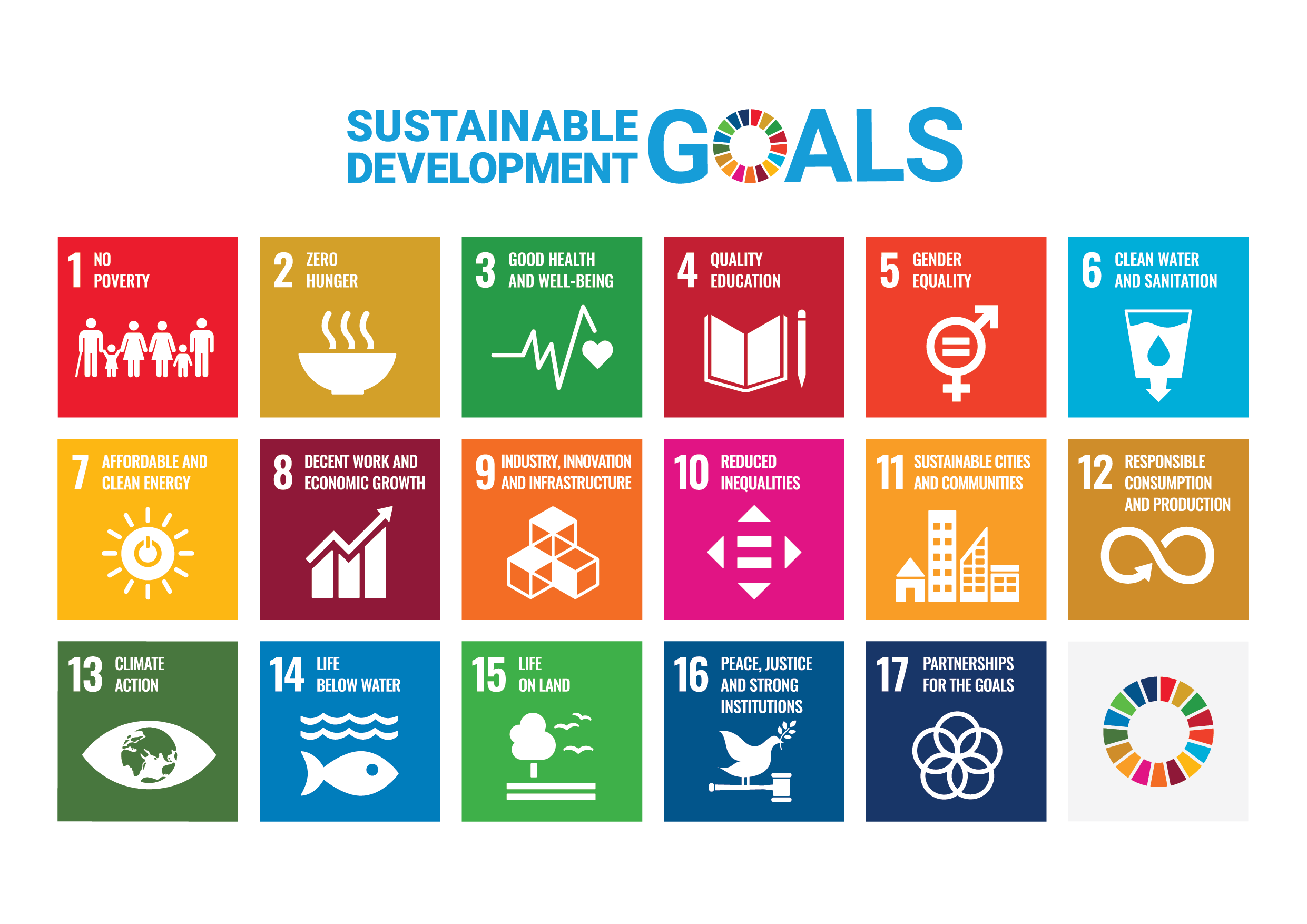

We oriënteren ons engagement aan zeven overkoepelende thema's, die aansluiten op de 17 Duurzameontwikkelingsdoelstellingen van de VN en de onderliggende targets.

Strategieën voor verantwoord beleggen

Particulieren, instellingen en bedrijven van over de hele wereld hebben hun vermogen bij ons ondergebracht zodat wij het kunnen beheren op een manier die strookt met hun financiële doelen én hun normen en waarden. Maar de optimale strategie voor verantwoord beleggen ziet er uiteraard niet voor iedereen exact hetzelfde uit.

Al ruim veertig jaar bewijzen we keer op keer dat we kunnen blijven innoveren en bieden we onze cliënten een royale selectie aan verantwoorde-beleggingsstrategieën aan, zie tijdslijn hieronder:

Bij ons heeft u ruim de keuze uit gepoolde ESG-fondsen voor alle belangrijke activaklassen, waaronder multi-assetfondsen en alternatieve beleggingen. Ongeacht waar u de nadruk wilt leggen in uw verantwoord-beleggingsmandaat, wij kunnen een oplossing samenstellen die naadloos aansluit op uw persoonlijke wensen.

(reo®) – Onze Responsible Engagement Overlay-service

In 2000 zetten we onze baanbrekende service Responsible Engagement Overlay (reo®) op, waarmee we engagement-initiatieven nemen en stemmen in het belang van onze cliënten. reo® zet de deur voor onze cliënten open naar al onze stewardship-expertise, waaronder:

SDG-gerichte verslaglegging waarin de impact van ons engagement wordt gekwantificeerd

Wereldwijde, sectoroverschrijdende dekking in het hele beurswaardespectrum

Meer dan 20 experts op het gebied van actief aandeelhouderschap

23 jaar ervaring met engagement-initiatieven

Houd er rekening mee dat de reo® – service mogelijk niet in alle rechtsgebieden beschikbaar is.

Wereldwijd stewardship en verantwoordingsplicht

Als grote, wereldwijde vermogensbeheerder beschouwen we het als onze plicht om ons hard te maken voor een goed geolied financieel stelsel. Vooral op lange termijn hebben onze cliënten en de samenleving als geheel hier enorm profijt van. We streven ernaar om onze verantwoordelijkheid als werkgever te nemen en actief bij te dragen aan de gemeenschappen waarin we actief zijn. Onze verantwoordelijkheid nemen is een fundamenteel uitgangspunt van onze bedrijfscultuur.

Deel van een ambitieus discours

We kunnen weldoordacht en proactief sturing uitoefenen op nieuw openbaar beleid, concreet door met

overheden en toezichthouders in gesprek te gaan over belangrijke kwesties – en zo de lat hoog te leggen als constructieve investeerder. We hebben ons aangesloten bij werkgroepen in verschillende sectoren: samen met andere investeerders kunnen we opkomende ESG-kwesties namelijk effectiever in kaart brengen en zo kunnen we onze opgedane inzichten met de bredere sector delen.

Doelgericht handelen

We zijn al jarenlang aangesloten bij gevestigde normen en gedragscodes voor verantwoord beleggen en we hebben ons erop toegelegd om ons tot een diverser, gelijkwaardiger en inclusiever bedrijf te ontwikkelen. Bovendien houden we altijd rekening met de klimaatimpact van onze onderneming en zetten we filantropische initiatieven op, zoals onze steun aan goede doelen. Een greep uit onze toezeggingen:

Ondertekenaar van de Stewardship Codes van het VK, Taiwan, Japan en Korea

Een van de allereerste ondertekenaars van de Principles for Responsible Investment van de Verenigde Naties

- Ondertekenaar van het Net Zero Asset Managers Initiative

- Lid van Climate Action 100+

- Lid van de Investor Alliance, die zich inzet voor de eerbiediging van mensenrechten

- Ondertekenaar van de Investor Stewardship Group in de VS, die bestaat uit investeerders en vermogensbeheerders die zich inzetten voor deugdelijke stewardship- en governance-praktijken

- Een van de allereerste ondertekenaars van het UK Women in Finance Charter

Policies

Disclosures

A

Adverse impact

Aggregate sustainability risk exposure

The overall sustainability risk faced by a company or portfolio, taking account of a range of issues such as climate risk and ESG factors.

B

Best-in-class

Best-in-class strategies try to make their portfolios better on ESG issues and/or carbon characteristics by excluding certain investments deemed negative in that respect or including certain investments deemed positive in that respect.

C

Carbon footprint

The carbon emissions and carbon intensity of a portfolio, compared with its investment universe (benchmark). The benchmark might be, for example, companies in the FTSE 100.

Carbon intensity

A company’s carbon emissions, relative to the size of the business. This allows investors to compare the company’s carbon efficiency with its competitors’.

Climate risk

The risk that an investment’s value could be harmed by climate issues such as global warming, energy transition and climate regulation. Investors normally assess climate risk by looking at carbon footprint data, climate adaptation risk, physical risk and stranded assets.

Climate adaptation risk

See Transition Risk.

Controversies

A company’s operational failures or everyday practices that have severe consequences for workers, customers, shareholders, wider society and the environment. Examples are poor employee relations, human rights abuses, failure to follow regulations, and pollution. Controversies help to indicate the quality of a company.

Corporate governance

The way that companies are organised and led. We look at how well companies are sticking to good practices set out in Corporate Governance Codes, which vary from country to country. Corporate governance is also part of the ‘G’ in ESG. In this context Governance may focus on the operational and management practices relating to social and environment aspects of the business.

Corporate Social Responsibility (CSR)

A company’s approach to (and engagement with) its stakeholders and the communities it operates in, reflecting its responsibility towards people and planet.

D

Decarbonisation

The reduction of the carbon emissions associated with a region, country, industry or organisation. It can also refer to the reduction of the carbon emissions associated with a fund’s investments.

Divestment

The opposite of investment. In other words, either reducing or exiting an investment. We divest if we think the potential risks of investing in a company outweigh the potential returns. This may be because we have lost confidence in a company’s leadership, strategy, practices or prospects .

E

Engagement

Talking to members of the board or management of a company – a two-way process that we might initiate, or the company might initiate. We use engagement to understand companies better. We also use it to give feedback, offer advice and seek changes – including change relating to ESG and climate risk. Engagement also means consulting with government and collaborating with other investors to influence policy and shape debate.

Environmental

The “E” in ESG. This covers a focus on significant environmental risks and their management. In a climate change context it is a focus on the risks associated with a business having to adapt to climate change requirements or the physical impacts of climate change. We also look at companies’ environmental opportunities due to changing consumer demands, policy changes, technology and innovation.

ESG

Short for environmental, social and governance. Investors consider companies’ ESG risks and how well they are managed. To do this, we use the Sustainability Accounting Standards Board (SASB) framework. Considering ESG gives us a different perspective on how good an investment might be.

ESG integration

Always taking account of ESG issues when assessing potential investment opportunities and monitoring the investments in a portfolio.

ESG ratings

Many investment managers use external providers, such as MSCI, to rate companies on their ESG practices. Each provider has its own way of doing things, so ESG scores can vary radically from one provider to another. We run our own ESG system to rate companies. This is based on 77 standards, each for a different industry, produced by the Sustainability Accounting Standards Board.

Ethical investing

An ethical approach excludes investments that conflict with the client values and ethics that a fund is seeking to reflect. There are many different activities or issues that people prioritise as ethical. Common examples include tobacco, adult entertainment, controversial weapons, coal or activities that contravene religious social teaching.

Exclusion

Excluding companies from a portfolio. Exclusions can also be used to set minimum standards or characteristics for inclusion of investments in portfolios. Fund managers may exclude entire industries (e.g. tobacco), companies involved in ethically questionable activities (e.g. gambling), companies that fail to meet certain ESG standards, and companies with a bad carbon intensity.

F

Fundamental analysis/research

Using research to work out the true value of an investment, rather than its current price. Many factors contribute to this, including responsible investment factors. Responsible investment helps us understand the quality of a company, its scope to develop and improve (e.g. in response to climate transition) and its prospects (through making money from responding to sustainability issues). Even if a company is good, it is unlikely to offer good investment returns if this is already reflected in the share price.

G

Green bonds

Debt issued by companies or governments, with the money raised earmarked for green initiatives such as building renewable energy facilities.

Greenwashing

Insincere approaches to climate change and other ESG issues by companies, including investment management firms. For example, an investment manager may label a fund as an ESG fund, even if it does not adopt ESG integration in practice.

I

Impact investing

International Labour Organisation (ILO)

A United Nations agency, often abbreviated to “ILO”, that sets international standards for fairness and safety at work. The ILO standards are commonly used by investors to assess how serious a corporate controversy is.

M

Materiality

An ESG issue is “material” if it is likely to have a significant positive or negative effect on a company’s value or performance.

N

Norms-based screening

Screening investments for potential controversies by looking at whether a company follows recognised international standards. We consider standards including the International Labour Organisation standards, the UN Guiding Principles for Business and Human Rights and the UN Global Compact. Specialist RI funds may exclude companies that do not meet these standards.

P

Physical risk

The physical risks of climate change for businesses, such as rising sea levels, water shortages and changing weather patterns.

Portfolio tilts

Investment industry jargon for having more of something in a portfolio than the benchmark, or less of it. In responsible investment it usually means having more companies in a portfolio that have better ESG credentials or are less exposed to climate risk than there is in the benchmark. The tilt is measured as the overall exposure to a specific type of investment in a portfolio compared to that in the benchmark.

Positive inclusion/screening

Seeking companies that have good ESG practices or that help the world economy be more sustainable. Also used as an alternative to “best-in-class“. The opposite of exclusion.

Principles for Responsible Investment

Often shortened to PRI. A voluntary set of six ethical principles that many investment companies have agreed to adopt. Principle 1, for example, is: “We will incorporate ESG issues into investment analysis and decision-making processes.” The PRI was sponsored by the United Nations. Columbia Threadneedle is a founding signatory, and has attained the top A+ headline rating for its overall approach for the sixth year running.

Proxy voting

Voting on behalf of our clients at company general meetings to show support of their practices and approach – or to show our dissent. We put our voting record on our website within seven days of the vote.

R

Responsible Investment (RI)

The umbrella term for our approach towards managing our clients’ money responsibly. This includes the integration of ESG factors, controversies, sustainability opportunities and climate risks into our investment research and engagements with companies, to inform our investment decisions and proxy voting.

Responsible Investment Ratings

Mathematical models created by our responsible investment analysts that provide an evidence-based and forward-looking indication of the quality of a business and its management of risk.

S

SDR (Sustainability Disclosure Requirements)

The Sustainability Disclosure Requirements (SDR) and labelling regime is a UK framework introduced by the Financial Conduct Authority (FCA) to improve transparency and consistency in how investment products and firms disclose sustainability-related information. It is part of the UK’s broader efforts to combat greenwashing (misleading sustainability claims about a product or service) and promote the transition to a greener economy. The SDR regime includes a robust anti-greenwashing rule, sustainability investment labels (to help investors find products that have a specific sustainability goal), as well as comprehensive disclosure rules and naming and marketing rules for retail funds.

SDR - Consumer-facing Disclosure (CFD)

The CFD is an important component of the FCA’s Sustainability Disclosure Requirements (SDR). It is a two-page document designed to help retail investors make informed decisions by providing a clear and concise overview of the sustainable features of funds that use a sustainability label, as well as funds that might not meet the criteria for a label, but nevertheless have certain sustainability-related characteristics.

SDR - Sustainability Focus

The Sustainability Focus Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in assets that focus on sustainability for people or the planet.

SDR - Sustainability Impact

The Sustainability Impact Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in solutions to sustainability problems, with an aim to achieve a positive impact for people or the planet.

SDR - Sustainability Improvers

The Sustainability Improvers Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that may not invest in assets that are sustainable now, but which aim to improve their sustainability for people or the planet over time.

SDR - Sustainability Mixed Goals

The Sustainability Mixed Goals Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in a mix of assets that either focus on sustainability, aim to improve their sustainability over time, or aim to achieve a positive impact for people or the planet.

Scope 1, 2 and 3 emissions

The building blocks used to measure the carbon emissions and carbon intensity of a company. Under an international framework called the Greenhouse Gas Protocol these are divided into Scope 1, 2 and 3 emissions. Scope 1 emissions are generated directly by the business (e.g. its facilities and vehicles). Scope 2 covers emissions caused by something a company uses (e.g. electricity). Scope 3 is the least reliable because it is the hardest to measure. It covers other indirect emissions generated by the products it produces (e.g. from people driving the cars a company makes).

Screened funds

Funds that use screens to exclude companies that do not meet their ethical criteria, ESG expectations, carbon intensity or controversy standards.

Social

The “S” in ESG. Investors analyse social risks and how these are managed. This includes a company’s treatment of its employees and its human rights record for other people outside the company (e.g. in the supply chain). It also refers to a company’s commercial opportunities in responding to changing consumer demands, policy changes or technology and innovation (e.g housing, education or healthcare).

Social bonds

Bonds issued to raise money for a socially useful purpose, such as education or affordable housing. Social bonds follow the standards set by the International Capital Market Association (ICMA) and appoint independent external reviewers to confirm the money raised will be used appropriately.

Socially Responsible Investing (SRI)

A form of ethical investment that attaches particular importance to avoiding harm to people or the planet, from the investments being made.

Stewardship

A catch-all term to describe the actions taken to look after our clients’ money. It commonly involves both engagement with companies, to develop a proper understanding of business developments, issues and potential concerns; and proxy voting to support or oppose issues at company general meetings.

Stranded assets

A variety of factors can lead to the risk of assets becoming stranded, such as new regulations or taxes (e.g. carbon taxes or changes in emission trading schemes) or changes in demand (e.g. impacts on fossil fuels, resulting from the shift towards renewable energy). Stranded assets risk having their value written down, impacting the value they have in a company’s accounts.

Sub-advisor

When one investment management company hires another investment management company to manage one of their funds, the hired company is the sub-advisor. Sub-advisors are sometimes used in responsible investment if they have specialist knowledge of this field that does not exist in-house.

Sustainability Accounting Standards Board

Often referred to as “SASB”, this is a non-profit organisation that sets standards for the sustainability information companies should communicate to their investors. It has produced 77 sets of industry-specific global standards. SASB looks for sustainability issues that are financially significant to a particular industry.

Sustainability risk

An environmental, social or governance risk that could hit the value of an investment.

Sustainable Development Goals (SDGs)

A set of 17 policy goals set out by the United Nations, which aim for prosperity for all without harming people and the planet. Each goal has a number of targets. For example, Goal 2 is Zero Hunger and Target 2.3 is to double the productivity and incomes of small-scale food producers. Companies can contribute to the SDGs by making products or services that help achieve at least one of the 17 goals.

Sustainable investing

Investing in a way that recognises the need for and supports balanced social, environmental and economic development for the long term.

T

Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures was set up by the World Bank to help companies communicate their climate risks and opportunities and how they manage them. The TFCD sets out a framework for communicating how management considers climate risks, its strategy for responding to climate change, risk management arrangements and the types of risk covered. The TCFD says companies should, for example, explain how their business strategies would cope in different temperature scenarios. From 2022 companies listed on the UK stock market will have to follow the TCFD’s recommendations for disclosing climate risks.

EU SFDR (Sustainable Finance Disclosure Regulation)

This forces funds to communicate how they integrate sustainability risk and consider adverse impacts. For funds promoting environmental or social characteristics or that are targeting sustainability objectives, additional information will need to be communicated.

The EU Taxonomy

Often called the “Green Taxonomy”. This is the EU’s system for deciding whether an investment is sustainable. Investments must contribute to one or more environmental objectives and meet the detailed criteria required for each activity or product that contributes to this. Investments must not do significant harm to any of the objectives. They must also meet minimum standards in business practices, labour standards, human rights, and governance.

Thematic investing

Researching global trends, or “themes”, to identify investments that will either benefit from changing needs or be impacted by them. Common themes are climate change and technological innovation. Often combined with sustainable investing, which looks at these trends but with an additional focus on the environmental or social implications of themes.

Transition risk

The potential risks faced by companies as society transitions towards alignment with the Paris Agreement to limit global warming. This is the risk that a company is so invested in certain incompatible operations and assets that it is uneconomical to transition to align with the Paris Agreement.

U

UN Global Compact (UNGC)

The world’s largest sustainability initiative. The UNGC sets out a framework based on Ten Principles for business strategies, policies and practices, designed to make businesses behave responsibly and with moral integrity. Companies can volunteer to sign the Compact, and can be struck off by the UN for breaking it. The Compact is commonly used by investors to assess how serious controversies are.

UN Guiding Principles for Business and Human Rights

A framework for companies to prevent human rights abuses caused by their activities. Commonly used by investors to assess the severity of companies’ human rights failures.

On RI investing the US is once again the land of opportunity

Belangrijke informatie

Voor marketingdoeleinden. Uw vermogen is blootgesteld aan risico’s. Columbia Threadneedle Investments is de wereldwijde merknaam van alle onderdelen van de groep Columbia en Threadneedle. Niet alle diensten, producten en strategieën worden aangeboden door alle entiteiten van de groep. Toegekende onderscheidingen of beoordelingen zijn mogelijk niet op alle entiteiten van de groep van toepassing.

Dit materiaal mag niet worden beschouwd als een aanbod, verzoek, advies of beleggingsaanbeveling. Dit document is geldig op de datum van publicatie en kan zonder voorafgaande kennisgeving worden gewijzigd. Informatie uit externe bronnen wordt betrouwbaar geacht, maar de juistheid en volledigheid ervan kan niet worden gegarandeerd. De effectieve beleggingsparameters worden overeengekomen en uiteengezet in het prospectus of de formele overeenkomst voor vermogensbeheer.

In het VK: Uitgegeven door Threadneedle Asset Management Limited (nr. 573204) en/of Columbia Threadneedle Management Limited (nr. 517895), beide ingeschreven in Engeland en Wales. Er is in het VK vergunning aan verleend door en ze staan daar onder toezicht van de Financial Conduct Authority.

In de EER: Uitgegeven door Threadneedle Management Luxembourg S.A., dat is ingeschreven in het Registre de Commerce et des Sociétés (Luxembourg) onder nr. B 110242 en/of Columbia Threadneedle Netherlands B.V., dat onder toezicht staat van de Nederlandse Autoriteit Financiële Markten (AFM) en ingeschreven is onder nr. 08068841.

In het Midden-Oosten: Dit document wordt verspreid door Columbia Threadneedle Investments (ME) Limited, dat onder toezicht staat van de Dubai Financial Services Authority (DFSA). Voor distributeurs: Dit document is bedoeld om distributeurs informatie te verstrekken over producten en diensten van de Groep en mag niet verder worden verspreid. Voor institutionele cliënten: De informatie in dit document is niet bedoeld als financieel advies en is uitsluitend bestemd voor personen met voldoende kennis van beleggen die voldoen aan de criteria van de toezichthouder om te kunnen worden beschouwd als een Professional Client of als Market Counterparties. Andere personen mogen zich er niet op baseren.

In Australië: Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414, en/of Columbia Threadneedle EM Investments Australia Limited [“CTEM”], ARBN 651 237 044. Met betrekking tot de financiële diensten die het verleent, zijn TIS en CTEM vrijgesteld van de vereiste te beschikken over een Australische vergunning voor financiële dienstverlening uit hoofde van de Corporations Act en vallen de bedrijven respectievelijk onder Class Order 03/1102 en Class Order 03/1099 inzake marketing en financiële dienstverlening aan Australische “wholesaleklanten” zoals gedefinieerd in Sectie 761G van de Corporations Act 2001. TIS staat in Singapore onder toezicht van de Monetary Authority of Singapore (registratienummer 201101559W) conform de Securities and Futures Act (Chapter 289), die afwijkt van de Australische wetgeving. Aan CTEM is vergunning verleend door en het staat onder toezicht van de FCA naar Brits recht, dat afwijkt van Australisch recht.

In Singapore: Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, dat in Singapore onder toezicht staat van de Monetary Authority of Singapore conform de Securities and Futures Act (Chapter 289). Ingeschreven onder nummer: 201101559W. Deze advertentie is niet beoordeeld door de Monetary Authority of Singapore.

In Japan: Columbia Threadneedle Investments Japan Co., Ltd. Financial Instruments Business Operator, de directeur-generaal van het Kanto Local Finance Bureau (FIBO) nr. 3281, en een lid van de Japan Investment Advisers Association.

In Hongkong: Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hongkong, waaraan de Securities and Futures Commission (“SFC”) vergunning heeft verleend voor het uitvoeren van gereglementeerde activiteiten van Type 1 (CE: AQA779). Geregistreerd in Hongkong ingevolge de Companies Ordinance (Chapter 622) onder nummer 1173058 en/of uitgegeven door Columbia Threadneedle AM (Asia) Limited, Unit 3004 Two Exchange Square, 8 Connaught Place, Central, Hongkong, waaraan de Securities and Futures Commission (“SFC”) vergunning heeft verleend voor het uitvoeren van gereglementeerde activiteiten van Type 4 en Type 9 (CE: ABA410). In Hongkong geregistreerd krachtens de Companies Ordinance (Chapter 622) onder nummer 14954504.