Our philosophy

One of the attractions of the Company’s investment mandate is the breadth of opportunities in global smaller companies, with many thousands of listed companies to choose from. This is a large, diversified universe of exciting opportunities and is not necessarily well researched or understood properly. This leads to ‘market inefficiency’ that we, as disciplined stock pickers, can take advantage of to aim to deliver superior investment performance over the long term. By having a large and experienced team of smaller company fund managers within Columbia Threadneedle Investments we are well placed to seek out exceptional investment opportunities.

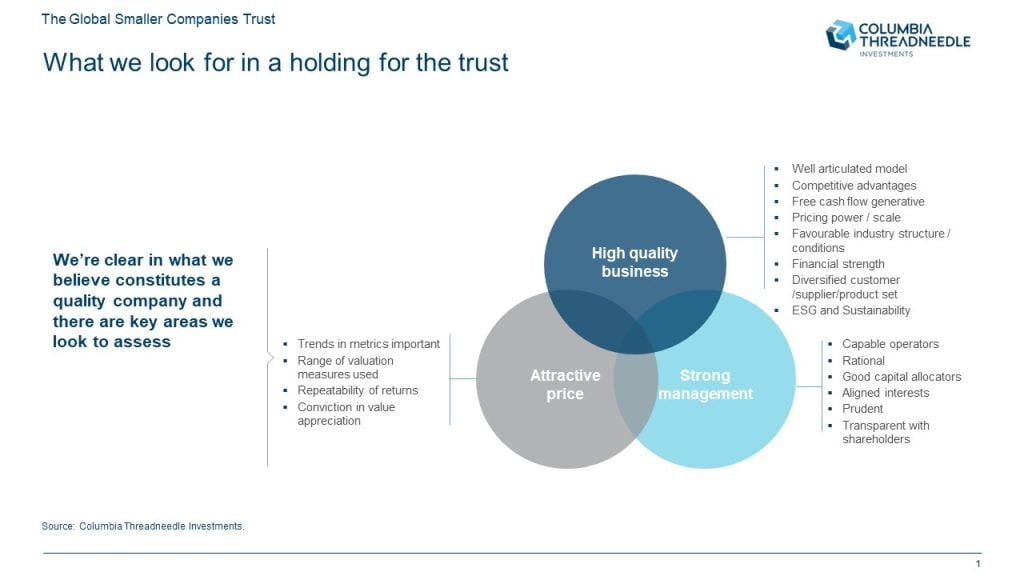

Our philosophy towards investing is based around our belief that investing in high quality companies, run by strong management teams, where the price we pay for our investment is attractive, will generate above average returns for our shareholders. We want to take a longterm approach towards all our investment decisions and do not look to engage in short-term trading.

Our process

We look at each potential investment through the same lens. The starting point is an assessment of the core quality of the business franchise. This will usually be ascertained through face-to-face meetings or calls with management, sometimes involving visits to business operations. We want to understand the business’s product or service offering and where it has competitive advantages over peers. Understanding the industry that potential investments operate in is also important as this will help us to recognise how much pricing power the business has – this is particularly important in the current higher inflationary world. We want companies that we invest in to have positive cashflow characteristics as this indicates good accounting quality, reduces the risk of funding difficulties and creates optionality for further growth. This also means that we will generally avoid conceptual and speculative companies without a track record of profitability. We like our holdings to have strong balance sheets as this promotes financial resilience.

Assessing the quality of the management teams we back is a critical part of the overall investment process. Management teams of smaller companies have a huge role to play in the evolution of their businesses. How they are motivated, rewarded and allocate capital is crucial in a company’s development, for better or for worse. We want to invest in management teams who make good long-term decisions with a track record of success and are rewarded for doing so. We also want management teams to be open communicators with the financial markets. There will often be short-term challenges for smaller companies but those management teams which clearly identify the issues that they are facing, and how they are addressing them, will earn greater support over the long term.

While we believe the evolution of a company’s profits and cash generation will ultimately be the principal determinant of shareholder returns, the fact is that many high quality businesses with good management teams may become overvalued in the stock market. We therefore need to assess carefully the price at which it makes sense for us to invest. We do this by looking at a number of different metrics including historic multiples that the company and its peers have traded at in the stock market, the prospective growth rate for the business and recently negotiated acquisitions of similar businesses. In addition, looking at projected cashflows and profits informs a view around the price that we should be happy to pay for the investment now.

Valuation discipline

Maintaining valuation discipline is crucial to long-term returns and often requires patience. Companies that reach our quality hurdle but do not appear attractively valued are placed on our watch list. This allows us to execute quickly when the opportunity presents itself. We have also had many cases in the past where we have sold a stock on valuation grounds and then re-purchased it at a later stage when the shares have derated. The experience of the team in terms of monitoring many potential investments means that we are able to keep refreshing the investment portfolio when existing holdings reach or exceed our assessed valuations.

Ultimately this approach should lead to a portfolio of higher quality smaller companies with the following characteristics:

- Proven business models that have scale advantages, a superior product or offering, valuable brands or intellectual property

- Management teams that have the right balance of entrepreneurial flair, consistent operational delivery and rational capital allocation track records

- Higher growth rates, margins and returns on capital than the market

- Superior cashflow generation and strong balance sheets that provide resilience and opportunity for value added capital deployment

While individual stock decisions are obviously key, we spend a lot of time too considering the balance of the investment portfolio both on an overall basis and across the regional portfolios. While clearly, we want to skew investment towards faster growing areas where returns will be best, we also want the Company to provide investors with a well-diversified portfolio. Previous periods, such as around the year 2000 and in the last year or two, have shown us the risks that can arise when investors become too focused on favoured sectors, such as technology. Investing in the best opportunities within slower growing or more mature industries can often prove more lucrative.

Diversified portfolio

The Company provides geographic diversification by investing in more than 40 countries. We monitor the weightings of our portfolio against the Benchmark index, but the location of where a company is listed does not always provide a true indication of where it is exposed. From time to time a particular macro-economic issue may provoke us to change geographic allocations, though individual stock idea flow will tend to be more important in driving exposure changes. As you will have seen in the Chairman’s Statement, the weighting of the UK market within the Benchmark has been reduced, reflecting the evolution of global markets. This is not expected to lead to any short-term changes in the portfolio.

In relation to our approach to investment in Japan and the Rest of World (Asia, Latin America and some other smaller markets outside of the main regions) we have, for many years, used third party managed collective funds to gain exposure to these markets. With a greater degree of investment resource towards these markets within Columbia Threadneedle Investments compared to previously under BMO or F&C, we will keep this approach under review.

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start investing from £2,000 for an adult account and £1,000 for a child account. Regular monthly contributions can be made from £25 or one-off additional investments from £100 after the minimum opening investment has been made. There are no dealing charges when you deal online.